Roads

-

Road Network Length

200,037 km

-

Road Infrastructure Quality

3.7

-

Number of PPPs Reaching FC

17

-

Value of PPPs Reaching FC

$ 4,310 M

-

Number of PPPs with Foreign Sponsors

5

-

Number of PPPs with Govt. Support

2

FC = financial closure, Govt. = government, km = kilometers, M = million.

Note: Quality of road infrastructure: 1 (lowest) – 7 (highest).

Sources: Trading Economics. Philippines-Road Total Network. https://tradingeconomics.com/philippines/roads-total-network-km-wb-data.html; The Global Economy. Compare Countries. https://www.theglobaleconomy.com/compare-countries/.

Roads

Contracting Agencies

The Department of Public Works and Highways (DPWH) implements road projects and offers concessions for PPP projects. For the Metro Manila Skyway Stage 3 project, however, the Toll Regulatory Board (TRB) acted as the implementing agency.

Roads

Sector Laws and Regulations

The TRB, created by the Toll Operation Decree (Presidential Decree 1112), acts as the main regulatory body for road sector PPP projects. It regulates the toll and publishes the toll rates on its website. As per the Limited Access Highway Act (Republic Act 2000), the Department of Public Works and Communications (now the DPWH) is authorized to design any limited access facility and to regulate, restrict, or prohibit access to best serve the traffic. The following are the key regulations that govern the road sector:

- Revised Philippine Highway Act (Presidential Decree 17, series of 1972).

- Limited Access Highway Act (Republic Act 2000).

- Right-of-Way Act (Republic Act 10752).

- Prohibited Uses within the Right-of-Way of National Roads (Department Order 73, 2014, DPWH).

Foreign Investment Restrictions

Parameter 2017 2018 2019 Maximum allowed foreign ownership of equity in greenfield projects 40% 40% 40% LEARN MORERoads

Sector Laws and Regulations

The maximum equity investment allowed for foreign investors in greenfield projects is 40%.1

- 1Government Procurement Policy Board. Republic Act 7718. An Act Authorizing the Financing, Construction, Operation and Maintenance of Infrastructure Projects by the Private Sector, and for Other Purposes. Manila. https://www.gppb.gov.ph/laws/laws/RA_6957.pdf

Roads

Sector Master Plan

In 2010, the DPWH and the Japan International Cooperation Agency (JICA) developed the Masterplan on High Standard Highway Network Development. The master plan covered areas within 200-kilometer radius from Metro Manila, Metro Cebu, and the Tagum–Davao–General Santos Corridor, totaling 3,460 kilometers of highways. In 2019, the DPWH partnered with JICA to prepare a new master plan for a high-standard highway network.1

- 1DPWH. News. https://www.dpwh.gov.ph/DPWH/news/15539.

PPP Priority Projects, 2020

No. Project Implementing

AgencyEstimated Project Cost Status ($ million) (₱ billion) 1. Southeast Metro Manila Expressway Project DPWH 894 45.29 Ongoing implementation 2. Metro Manila Skyway Stage 3 DPWH 739 37.43 Ongoing implementation 3. NLEX–SLEX Connector Road DPWH 460 23.30 Ongoing implementation 4. C5 Southlink Expressway Project DPWH 250 12.64 Ongoing implementation 5. Southern Luzon Expressway Toll Road 4 DPWH 377 19.10 Ongoing implementation 6. Quezon–Bicol Expressway DPWH 1,763 89.30 Under preparation 7. Tarlac–Pangasinan–La Union Expressway Extension Project DPWH 473 23.95 Under preparation – Advanced stages of government approval 8. Cavite–Tagaytay–Batangas Expressway Project DPWH 443 22.43 Under preparation DPWH = Department of Public Works and Highways, NLEX = North Luzon Expressway, SLEX = South Luzon Expressway.

Note: ₱1 = $ 0.01974.

Source: National Economic Development Authority (NEDA). 2020. Revised List of Infrastructure Flagship Projects. Manila. https://www.neda.gov.ph/infrastructure-flagship-projects/.

Projects under Preparation and Procurement

Roads Public–Private Partnerships under Preparation and Procurement

LEARN MORERoads

Sector Master Plan

The PPP Center tracks the progress of a pipeline of PPP projects in the Philippines, which is updated regularly and published on the PPP Center website.1

- 1DPWH. PPP Menu. http://www.dpwh.gov.ph/dpwh/ppp/priority; Public–Private Partnership Center. List of Projects. https://ppp.gov.ph/list-ofprojects/(accessed 28 August 2020).

Pipeline of PPP Road Projects

No. Type of Contract Length (km)

AgencyEstimated Project Cost ($ million) (₱ billion) 1. Central Luzon Link Expressway Phase II (Cabanatuan–San Jose, Nueva Ecija) 35.7 249 12.61 2. Tarlac–Pangasinan–La Union Expressway Extension 59.4 473 23.94 3. Quezon–Bicol Expressway 220 1,763 89.3 4. Davao–Digos Expressway 60 NA NA 5. Metro Cebu Expressway (Cebu Circumferential Road) 73.75 555 28.1 6. Mindoro–Batangas Super Bridge (Floating Bridge) 15 TBD TBD 7. North Luzon Expressway East, Phase II 99.1 881 44.61 8. Delpan–Pasig–Marikina Expressway 25 TBD TBD 9. Operation, Maintenance and Improvement of Kennon Road and Marcos Highway 33.7 TBD TBD 10. Cavite–Tagaytay–Batangas Expressway Project 50 446 22.59 11. Davao People Mover Project 13 592 30 ₱1 = $0.01974, TBD = To be decided

Sources: National Economic Development Authority. 2020. Revised List of Infrastructure Flagship Projects. Manila; https://ppp.gov.ph/list-of-projects/; Department of Public Works and Highways. List of

Public–Private Partnership (PPP) Priority Projects. http://www.dpwh.gov.ph/dpwh/ppp/priority (accessed 28 August 2020); Public–

Private Partnership Center. 2019. Investment Opportunities. Manila. https://ppp.gov.ph/investors-corner/investment-opportunities-2/.Source: Public–Private Partnership Center. List of Projects. https://ppp.gov.ph/list-of-projects/ (accessed 28 August 2020); Public– Private Partnership Center. 2019. Investment Opportunities. Manila. https://ppp.gov.ph/investors-corner/investment-opportunities-2/.

Roads

Features of Past PPP Projects

Procurement of PPP Projects

Roads Public-Private Partnerships procured through various modes

Note: Only active projects are considered in the above graph.

Source: ADB, World Bank. Infrastructure Finance, PPPs and Guarantees. Country Snapshots. Philippines. https://ppi.worldbank.org/en/snapshots/country/philippines (accessed 28 August 2020).

PPP Projects Reaching Financial Close

Roads Public-Private Partnerships reaching Financial Close

Note: Only active projects are considered in the above graph. The number includes the Don Muang Tollway project, which reached financial closure before 1990.

Source: ADB, World Bank. Infrastructure Finance, PPPs and Guarantees. Country Snapshots. Philippines. https://ppi.worldbank.org/en/snapshots/country/philippines (accessed 28 August 2020).

PPP Projects with Foreign Sponsor Participation

Roads Public-Private Partnerships with Foreign Sponsor Participation

Note: Only active projects are considered in the above graph.

Source: ADB, World Bank. Infrastructure Finance, PPPs and Guarantees. Country Snapshots. Philippines. https://ppi.worldbank.org/en/snapshots/country/philippines (accessed 28 August 2020).

Government Support to PPP Projects

Government Support for Roads Public-Private Partnerships

Note: Only active projects are considered in the above graph.

Source: ADB, World Bank. Infrastructure Finance, PPPs and Guarantees. Country Snapshots. Philippines. https://ppi.worldbank.org/en/snapshots/country/philippines (accessed 28 August 2020).

Payment Mechanism for PPP Projects

Payment Mechanisms for Roads Public-Private Partnerships

Note: Only active projects are considered in the above graph.

Source: ADB, World Bank. Infrastructure Finance, Public–Private Partnerships and Guarantees. Country Snapshots. Philippines.

https://ppi.worldbank.org/en/snapshots/country/philippines (accessed 28 August 2020).Typical Risk Allocation for PPP Projects

Risk Type Private Public Shared Comment Traffic risk Collection risk Competition risk Government payment risk There are no government payment road PPPs Environmental and social risk (unsolicited) (solicited) To be obtained by private sector for unsolicited proposals and by public and pivate sector for solicited proposals Land acquisition risk (unsolicited) (solicited) To be obtained by private sector for unsolicited proposals and by public sector for solicited proposals Permits Geotechnical risk Brownfield risk: inventories studies, property boundaries, project scope Political risk Force majeure Foreign exchange risk Construction risk - Yes

Financing Details

Parameter 1990–2017 1990–2018 1990–2019 PPP projects with foreign lending participation 0 0 0 PPP projects that received export credit agency/international financing institution support 2 2 2 Typical debt:equity ratio 70:30 to 80:20 Time for financial closure 3 months after the issuance of Notice to Proceed Typical concession period 20–25 years Typical Financial Internal Rate of Return UA - UA = Unavailable

Source: ADB, World Bank. Infrastructure Finance, PPPs and Guarantees. Country Snapshots. Philippines. https://ppi.worldbank.org/en/snapshots/country/philippines (accessed 28 August 2020).

Roads

Tariffs

The TRB sets the rates of tolls to be charged on national highways, roads, and bridges (see table below). Local government units (LGUs) can set toll fees or charges to any regional public road, bridge, pier, waterway, ferry, or telecommunication system which they have funded and constructed.1

For build–operate–transfer projects, contractors may charge and collect toll fees and charges. Such charges/fees must be based on the terms incorporated in the concession agreement and not exceed the charges proposed in the bid. These fees and charges are to be approved by LGUs. The LGU is responsible for the adjustment of the fees and charges over time, in response to macroeconomic variables (footnote 1).

The tariffs for toll roads are published on the TRB website.2

- 1ADB. 2019. Public–Private Partnership Monitor Second Edition. Manila. https://www.adb.org/sites/default/files/publication/509426/ppp-monitorsecond-edition.pdf.

- 2Toll Regulatory Board. http://trb.gov.ph./ (accessed 4 July 2020).

Tariffs for Toll Roads

Road Toll Type Class 1: Cars, Jeepneys, Pickups, Vans (₱) Class 2: Light Trucks, Tourist and School Buses, Class 1 > 7 feet in height (₱) Class 3: Heavy and Multiaxle Trucks, Trailers (₱) Subic–Clark–Tarlac Expressway Close 5–324 11–648 140–180 Muntinlupa–Cavite Expressway Open 17 35 52 North Luzon Expressway Close 6-485 11–1,113 18–1,455 Source: Toll Regulatory Board. http://trb.gov.ph./ (accessed 28 August 2020).

Roads

Challenges

- Restriction on foreign investments (capped at 40% for greenfield projects) limits the competition in the sector, as the controlling stake in the project company belongs to local companies. The government is taking steps to ease the restriction on foreign investment to attract international investors.

- Land acquisition delays have been a common challenge in road projects. Many projects had been awarded before the right-of-way was acquired. This led to tie and cost overruns.

- There have been several challenges in regard to procurement:

- The tendering in the past had been subject to delays. Moreover, certain tenders did not give sufficient time for the developers to prepare the bids.

- In the past, the government introduced changes in the project structure during tender process.

- The private sector has limited opportunity to negotiate key terms of the contract, especially on risk allocation.

-

Railways

-

Railway Network Length

995 km

-

Number of Passengers

384 M pkm

-

Freight Volume

UA

-

Railway Infrastructure Quality

2.4

-

Number of PPPs Reaching FC (#)

2

-

Value of PPPs Reaching FC

$ 2,519 M

-

Number of PPPs with Foreign Sponsors

1

-

Number of PPPs with Govt. Support

----

FC = financial closure, Govt = government, km = kilometers, M = million, pkm = passenger-kilometer, ton-km = ton-kilometer.

Notes: Passenger-kilometer refers to the transport of one person over 1 km, with the data expressed in millions of pkm. Ton-kilometer refers to the transport of a ton of cargo over 1 km, with the data expressed in millions of ton-km. Quality of railway infrastructure: 1 (lowest) – 7 (highest).

Sources: The Economist Intelligence Unit. Philippines. https://infrascope.eiu.com/; The Global Economy. Railway Passengers—Country Rankings. https://www.theglobaleconomy.com/rankings/railway_passengers/; The Global Economy. Railway Transport of Goods—Country Rankings. https://www.theglobaleconomy.com/rankings/Railway_transport_of_goods/; The Global Economy. Railroad Infrastructure Quality—Country Rankings. https://www.theglobaleconomy.com/rankings/railroad_quality/.

Railways

Contracting Agencies

Various government agencies and state-owned enterprises could act as concessionaires:

- The Light Rail Transit Authority (LRTA) is a wholly state-owned government corporation created under Executive Order 603. The LRTA is primarily responsible for the construction, operation, maintenance, and/or lease of light rail transit systems in the Philippines.

- The Department of Transportation (DOTr) is the primary policy, planning, programming, coordinating, implementing, and administrative entity of the government’s executive branch on the promotion, development, and regulation of a dependable and coordinated network of transportation and communications systems.1

- The Philippine National Railways (PNR) was established by Republic Act 10638 in 2013. The PNR operates the Metro South and North commuter trains in Manila.

- 1Department of Transportation and Communication. http://www.dotr.gov.ph/.

Railways

Sector Laws and Regulations

The Land Transportation Franchising and Regulatory Board (an agency of DOTr) sets routes, regulates fares, and oversees licensing requirements for land-based transportation services.

Foreign Investment Restrictions

Parameter 2017 2018 2019 Maximum allowed foreign ownership of equity in greenfield projects 40% 40% 40% LEARN MORERailways

Sector Laws and Regulations

The maximum equity investment allowed for foreign investors in greenfield projects is 40%.1

- 1Government Procurement Policy Board. Republic Act 7718. An Act Authorizing the Financing, Construction, Operation and Maintenance of Infrastructure Projects by the Private Sector, and for Other Purposes. Manila. https://www.gppb.gov.ph/laws/laws/RA_6957.pdf.

Railways

Sector Master Plan

There is no sector-specific master plan for the railway sector.

PPP Priority Projects in the Railway Sector

No. Project Implementing Agency Estimated Cost Status ($ million) (₱ billion) 1. Manila Metro Line 1 Cavite Extension (Baclaran–Niog, Bacoor) (LRT 1 Cavite Extension Project) Department of Transportation 1,281 64.9 Under pre-construction 2. MRT 7 Department of Transportation 1,398 70.8 Under preparation – under evaluation by relevant approving body 3. C5 MRT 10 Project Department of Transportation 1,608 81.47 Under preparation – under evaluation by relevant approving body 4. Fort Bonifacio–Makati Sky Train Department of Transportation 69 3.52 Under preparation – under evaluation by relevant approving body 5. MRT 11 Department of Transportation 1,404 71.11 Under preparation – under evaluation by relevant approving body 6. LRT 6 Cavite Line N: Modified LRT 6 Project Phases 1 (Niog–Dasmarinas City) and 2 (Dasmarinas City–Tagaytay) Department of Transportation 995 50.38 Under preparation – under evaluation by relevant approving body 7. Cebu Monorail System Department of Transportation 1,557 78.89 Under preparation – under evaluation by relevant approving body LRT = light rapid transit, MRT = mass rapid transit.

Note: ₱1 = $ 0.01974.

Source: NEDA. 2020. Revised List of Infrastructure Flagship Projects. Manila. https://www.neda.gov.ph/infrastructure-flagship-projects/.

Projects under Preparation and Procurement

Railways Public-Private Partnerships under Preparation and Procurement

LEARN MORERailways

Sector Master Plan

The PPP Center tracks the progress of a pipeline of PPP projects in the Philippines, which is updated regularly and published on the PPP Center website.1

- 1PPP Center. List of Projects. https://ppp.gov.ph/list-of-projects/.

Pipeline of PPP Railway Projects

No. Project Implementing Agency Estimated Total Investment ($ million) (₱ billion) 1. C5 MRT 10 Projecta Department of Transportation 1,583 80.17 2. Cebu Monorail Transit System Project Department of Transportation 1,446 73.24 3. East–West Rail Projecta Philippine National Railways 1,095 55.46 4. Fort Bonifacio–Makati Skytrain Projecta Department of Transportation 69 3.52 5. MRT-11 Projecta Department of Transportation 1,404 71.11 6. Modified Light Rail Transit (LRT)-6 Project (formerly LRT 6 Cavite Line A) Department of Transportation 1,111 56.27 7. MRT 7 Airport Access–North Line Philippine National Railways 274 13.9 8. MRT 7 Katipunan Spur Line Philippine National Railways 2,112 107 9. Cavite LRT Line 6c and Sucat Line 6b Projectsb Department of Transportation 3,100 157.02 - a a b c d The estimated investment values were given in Investment Opportunities, December 2019, published by the Public–Private Partnership Center of the Philippines.

- bThis project was mentioned in Investment Opportunities, December 2019, published by the Public–Private Partnership Center of the Philippines. Projects 1 to 8 were published by the Public–Private Partnership Center of the Philippines.

LRT = light rapid transit, MRT = mass rapid transit

Note: ₱ 1 = $ 0.01974.

Source: Public–Private Partnership Center. List of Projects. https://ppp.gov.ph/list-of-projects/ (accessed 28 August 2020); Public– Private Partnership Center. 2019. Investment Opportunities. Manila. https://ppp.gov.ph/investors-corner/investment-opportunities-2/.

Railways

Features of Past PPP Projects

Procurement of PPP Projects

Railways Public-Private Partnerships procured through various modes

Note: Only active projects are considered in the above graph.

Source: ADB, World Bank. Infrastructure Finance, PPPs and Guarantees. Country Snapshots. Philippines. https://ppi.worldbank.org/en/snapshots/country/philippines (accessed 28 August 2020).

PPP Projects Reaching Financial Close

Railways Public-Private Partnerships reaching Financial Close

Note: Only active projects are considered in the above graph.

Source: ADB, World Bank. Infrastructure Finance, PPPs and Guarantees. Country Snapshots. Philippines. https://ppi.worldbank.org/en/snapshots/country/philippines (accessed 28 August 2020).

PPP Projects with Foreign Sponsor Participation

Railways Public-Private Partnerships with Foreign Sponsor Participation

Note: Only active projects are considered in the above graph.

Source: ADB, World Bank. Infrastructure Finance, PPPs and Guarantees. Country Snapshots. Philippines. https://ppi.worldbank.org/en/snapshots/country/philippines (accessed 28 August 2020).

Government Support to PPP Projects

Government Support for Railways Public-Private Partnerships

Note: Only active projects are considered in the above graph.

Source: ADB, World Bank. Infrastructure Finance, PPPs and Guarantees. Country Snapshots. Philippines. https://ppi.worldbank.org/en/snapshots/country/philippines (accessed 28 August 2020).

Payment Mechanism for PPP Projects

Payment Mechanisms for Railways Public-Private Partnerships

Note: Only active projects are considered in the above graph.

Source: ADB, World Bank. Infrastructure Finance, PPPs and Guarantees. Country Snapshots. Philippines. https://ppi.worldbank.org/en/snapshots/country/philippines (accessed 28 August 2020).

Typical Risk Allocation for PPP Projects

Risk Type Private Public Shared Comments Demand risk For MRT-3 Line, the government assumed the risk; however, preferred risk allocation is private. For LRT-1 extension, the private party bears the risk. Revenue collection risk Tariff risk Government payment risk Environmental and social risk Land acquisition risk Interface Handover Political risk Foreign exchange risk For MRT-3 Line, government assumed the risk; however, preferred risk allocation is private. Early termination risk - Yes

Financing Details

Parameter 1990-2017 1990-2018 1990-2019 PPP projects with foreign lending participation 0 0 1 PPP projects that received export credit agency/international financing institution support 0 0 0 Typical debt:equity ratio 70:30 Time for financial closure 18 months after commercial close Typical concession period 25–30 yearsa Typical Financial Internal Rate of Return UA - aConcession period for MRT-7 and LRT-1 was 25 and 30 years, respectively.

- UA = Unavailable

Source: ADB, World Bank. Infrastructure Finance, PPPs and Guarantees. Country Snapshots. Philippines. https://ppi.worldbank.org/en/snapshots/country/philippines (accessed 28 August 2020).

Railways

Tariffs

Currently, the MRT Line-3 employs distance-based fare structure, with fares ranging from ₱13 ($0.26 as of April 2020) to ₱28 ($0.55 as of April 2020), depending on the number of stations traveled. It is understood that tariffs are not being revised and escalated on a regular basis.

Railways

Challenges

- Restriction on foreign investments (capped at 40% for greenfield projects) limits the competition in the sector, as the controlling stake in the project company belongs to local companies. The government is taking steps to ease the restriction on foreign investment to attract international investors.

- Land acquisition remains a key challenge. San Miguel Corporation secured the mandate for LRT-7, which was delayed initially due to land acquisition issues. As the project had extended beyond prescribed deadlines, the project had to be taken back through government approval processes. San Miguel Corporation subsequently sought to restructure its consortium and financing.1

- LRT-6 projects did not attract sufficient market interest due to project feasibility challenges. Feasibility and alignment studies are currently being revisited. These projects were reviewed by implementing agencies in January 2017 to evaluate various options to optimize their feasibilities (footnote 1).

- There have been several challenges in regard to procurement:

- Tendering in the past had been subject to delays. Moreover, certain tenders did not give sufficient time for the developers to prepare the bids.

- In the past, the government introduced changes in the project structure during the tender process.

- The private sector has limited opportunity to negotiate key terms of the contract, especially on risk allocation.

- 1ADB. 2019. Public–Private Partnership Monitor Second Edition. Manila. https://www.adb.org/sites/default/files/publication/509426/ppp-monitorsecond-edition.pdf

-

Ports

-

Number of Ports

68

-

Container Traffic

8,637,520 TEU

-

Port Infrastructure Quality

2.9

-

Number of PPPs Reaching FC

9

-

Value of PPPs Reaching FC

$ 607 M

-

Number of PPPs with Foreign Sponsors

1

-

Number of PPPs with Govt. Support

----

FC = financial closure, Govt. = government, M = million, TEU = twenty-foot equivalent unit.

Note: Quality of port infrastructure: 1 (lowest) – 7 (highest).

Sources: World Port Source. Ports. http://www.worldportsource.com/countries.php; The Global Economy. Port Traffic—Country Rankings. https://www.theglobaleconomy.com/rankings/Port_traffic/; https://infrascope.eiu.com/

Ports

Contracting Agencies

The Department of Transport (DOTr) and the Philippine Ports Authority (PPA), a state-owned enterprise, are the key government contracting agencies in the port sector.

Ports

Sector Laws and Regulations

The PPA is a government-owned and controlled corporation (GOCC) attached to the DOTr. It is responsible for policy and program coordination. In October 2018, the PPA issued the Guidelines for the Selection and Award of Contract under the Port Terminal Management Regulatory Framework (Administrative Order 12).

The PPA regulates private ports through issuance of permits to construct and operate ports, approval of increases in cargo-handling rates, and collection of shares from port dues. Six independent port authorities, which operate outside the control of the PPA, can set their own rates for port charges, but they would normally follow the lead of the state-run ports authority.1

The Maritime Industry Authority, attached to the DOTr, was created in 1974. The government agency regulates domestic and overseas shipping, shipbuilding, ship repair, and the maritime workforce. The Maritime Industry Authority is not involved in ship-operating activities (footnote 1).

- 1ADB. 2019. Public–Private Partnership Monitor Second Edition. Manila. https://www.adb.org/sites/default/files/publication/509426/ppp-monitorsecond-edition.pdf

Functions of the Maritime Industry Authority and the Philippine Ports Authority

Agency Function Maritime Industry Authority - Develop and formulate plans, policies, programs, projects, standards, specifications, and guidelines geared toward the promotion and development of the maritime industry, the growth and effective regulation of shipping enterprises, and the national security objectives of the country

- Establish, prescribe, and regulate routes, zones, and/or areas of operation of particular operators of public water services

- Issue certificates of public convenience for the operation of domestic and overseas water carriers

- Register vessels and issue certificates and licenses

- Undertake the safety regulatory functions pertaining to vessel construction and operation including the determination or manning levels and issuance of certificates of competency to seafarers

- Enforce laws and prescribe and enforce rules and regulations (including penalties for violations), govern water transportation and the Philippine merchant marine, and deputize the Philippine Coast Guard and other law enforcement agencies to effectively discharge these functions

- Undertake the issuance of license to qualified seafarers and harbor, bay, and river pilots

- Determine, fix, and/or prescribe charges and/or rates pertinent to the operation of public water transport utilities, facilities, and services except in cases where charges or rates are established by international bodies or associations of which the Philippines is a participating member, or by bodies or associations recognized by the Government of the Philippines as the proper arbiter of such charges or rates

- Accredit marine surveyors and maritime enterprises engaged in shipbuilding, ship repair, ship breaking, domestic and overseas shipping, and ship management

- Issue and register the continuous discharge book of Filipino seafarers

- Establish and prescribe rules and regulations and standards and procedures for the efficient and effective discharge of the above functions

- Perform such other functions as may now or hereafter be provided by law

Philippine Ports Authority - Formulate, in coordination with the National Economic and Development Authority, a comprehensive and practicable port development for the state, program its implementation, and renew and update the same annually in coordination with other national agencies

- Supervise, control, regulate, construct, maintain, operate, and provide the facilities or services that are necessary in the ports vested in, or belonging to, the Philippine Ports Authority

- Prescribe rules and regulation, procedures, and guidelines governing the establishment, construction, maintenance, and operations of all other ports, including private ports in the country

- License, control, regulate, and supervise any construction or structure within any port district

- Provide services (whether on its own, by contract, or otherwise) within the port district and the approaches thereof, including but not limited to berthing, towing, mooring, moving, slipping, or docking any vessel; loading or discharging any vessel; and sorting, weighing, measuring, warehousing, or otherwise handling goods

- Exercise control of or administer any foreshore rights or leases which may be vested in the Philippine Ports Authority from time to time

- Coordinate with the Bureau of Lands or any other government agency or corporation in the development of any foreshore area

- Control, regulate, and supervise pilotage and the conduct of pilots in any port district

- Provide or assist in the provision of training programs and training facilities for its staff of port operators and users for the efficient discharge of its functions, duties, and responsibilities

Sources: Maritime Industry Authority. 2007. Annual Report 2007. Manila. www.marina.gov.ph/reports/AR2007.pdf; Department of Transportation and Communications and the Philippine Ports Authority. 2015. Davao Sasa Port Modernization Project. Information Memorandum. Manila. http://dotr.gov.ph/images/PPP/2015/P17BDavaoSasaPortMP/filepart1.pdf; ADB. 2019. Public–Private Partnership Monitor. Second Edition. Manila. https://www.adb.org/sites/default/files/publication/509426/ppp-monitor-secondedition.pdf.

Foreign Investment Restrictions

Parameter 2017 2018 2019 Maximum allowed foreign ownership of equity in greenfield projects 40% 40% 40% LEARN MOREPorts

Sector Laws and Regulations

The maximum equity investment allowed for foreign investors in greenfield projects is 40%.1

- 1Government Procurement Policy Board. Republic Act 7718. An Act Authorizing the Financing, Construction, Operation and Maintenance of Infrastructure Projects by the Private Sector, and for Other Purposes. Manila. https://www.gppb.gov.ph/laws/laws/RA_6957.pdf.

Ports

Sector Master Plan

The ports sector does not have a sector specific master plan. PPPs in the ports sector are not listed in NEDA’s Revised List of Infrastructure Flagship Projects (published on 17 February 2020).

Projects under Preparation and Procurement

Ports Public-Private Partnerships under Preparation and Procurement

LEARN MOREPorts

Sector Master Plan

The Public–Private Partnership Center tracks the progress of a pipeline of PPP projects in the Philippines, which is updated regularly and published on the PPP Center website.

Port Projects (as of March 2020)

No. Project Name Implementing Agency Estimated Project Cost ($ million) (₱ billion) 1. Preservation and Development of Laguna de Bay Project Laguna Lake Development Authority 370 18.7 2. San Ramon Newport Project Zamboanga City Special Economic Zone Authority TBD TBD 3. Redevelopment of the Port of Irene Cagayan Economic Zone Authority 84 4,231 TBD = to be decided.

Note: ₱1 = $0.01974.

Source: Public–Private Partnership Center. 2019. Investment Opportunities. Manila. https://ppp.gov.ph/investors-corner/investmentopportunities-2/.

Source: Public–Private Partnership Center. List of Projects. https://ppp.gov.ph/list-of-projects/ (accessed 28 August 2020);

Public–Private Partnership Center. 2019. Investment Opportunities. Manila. https://ppp.gov.ph/investors-corner/investmentopportunities-2/Ports

Features of Past PPP Projects

Procurement of PPP Projects

Ports Public-Private Partnerships procured through various modes

Note: Only active projects are considered in the above graph.

Source: ADB, World Bank. Infrastructure Finance, PPPs and Guarantees. Country Snapshots. Philippines. https://ppi.worldbank.org/en/snapshots/country/philippines (accessed 28 August 2020).

PPP Projects Reaching Financial Close

Ports Public-Private Partnerships reaching Financial Close

Note: Only active projects are considered in the above graph.

Source: ADB, World Bank. Infrastructure Finance, PPPs and Guarantees. Country Snapshots. Philippines. https://ppi.worldbank.org/en/snapshots/country/philippines (accessed 28 August 2020).

PPP Projects with Foreign Sponsor Participation

Ports Public-Private Partnerships with Foreign Sponsor Participation

Note: Only active projects are considered in the above graph.

Source: ADB, World Bank. Infrastructure Finance, PPPs and Guarantees. Country Snapshots. Philippines. https://ppi.worldbank.org/en/snapshots/country/philippines (accessed 28 August 2020).

Government Support to PPP Projects

Government Support for Ports Public-Private Partnerships

Note: Only active projects are considered in the above graph.

Source: ADB, World Bank. Infrastructure Finance, PPPs and Guarantees. Country Snapshots. Philippines. https://ppi.worldbank.org/en/snapshots/country/philippines (accessed 28 August 2020).

Payment Mechanism for PPP Projects

Payment Mechanisms for Ports Public-Private Partnerships

Note: Only active projects are considered in the above graph.

Source: ADB, World Bank. Infrastructure Finance, PPPs and Guarantees. Country Snapshots. Philippines. https://ppi.worldbank.org/en/snapshots/country/philippines (accessed 28 August 2020).

Financing Details

Parameter 1990–2017 1990–2018 1990–2019 PPP projects with foreign lending participation 2 2 2 PPP projects that received export credit agency/international financing institution support 0 0 0 Typical debt:equity ratio 0 0 0 Time for financial closure UA Typical concession period 25 years Typical Financial Internal Rate of Return UA - UA = Unavailable

Source: ADB, World Bank. Infrastructure Finance, PPPs and Guarantees. Country Snapshots. Philippines. https://ppi.worldbank.org/en/snapshots/country/philippines (accessed 28 August 2020).

Ports

Tariffs

Tariffs for the port sector are set and regulated by the Philippine Ports Authority. Terminal handling charges (THC) are set by the terminal operators for container movement services at a terminal. For container terminals, THCs cover the movement of a container between the ship’s hold and the exit–entry gate via the container terminal yard. Actual THCs may vary from port to port of each country, as the cost of handling depends on the contractual agreement between terminal operators and the relevant shipping line.1

- 1ADB. 2019. Public–Private Partnership Monitor. Second Edition. Manila. https://www.adb.org/sites/default/files/publication/509426/ppp-monitorsecond-edition.pdf.

Terminal Handling Charges for the Port Sector

Designation Company Year Terminal Handling Charge ($) 20-foot equivalent unit 40-foot equivalent unit Shipping line K LINE 2017 133 166 Shipping line OOLA 2016 125 155 Terminal operator MICT 2015 98 137 Terminal operator Philippine Ports Authority 2013 75 175 K LINE = Kawasaki Kisen Kaisha Ltd., MICT = Manila International Container Terminal.

Source: ADB. 2019. Public–Private Partnership Monitor. Second Edition. Manila. https://www.adb.org/sites/default/files/publication/509426/ppp-monitor-second-edition.pdf

Ports

Challenges

- Restriction on foreign investments (capped at 40% for greenfield projects) limits the competition in the sector, as the controlling stake in the project company belongs to local companies. The government is taking steps to ease the restriction on foreign investment to attract international investors.

- The combined regulatory and development function of the Philippine Ports Authority creates conflict of interest.

- There are cases where tenders have been canceled, and this has led to uncertainty among bidders.

-

Airports

-

Number of Airports

71

-

Passenger Capacity

43.08 M

-

Airport Infrastructure Quality

4.1

-

Number of PPPs Reaching FC

3

-

Value of PPPs Reaching FC

$ 646 M

-

Number of PPPs with Foreign Sponsors

1

-

Number of PPPs with Govt. Support

----

FC = financial closure, Govt. = government, M = million.

Note: Quality of airport infrastructure: 1 (lowest) – 7 (highest).

Sources: City Population. Airports. https://www.citypopulation.de/en/world/bymap/airports.html; World Bank. Air Transport, Passengers Carried. https://data.worldbank.org/indicator/is.air.psgr?locations=bd-kh-ge-kz-mm-pk-pg-lk-uz-vn-cn-in-id-ph-th; The Global Economy. Compare Countries. https://www.theglobaleconomy.com/compare-countries/; ADB. Cumulative Lending, Grant, and Technical Assistance Commitments. https://data.adb.org/dataset/cumulative-lending-grant-and-technical-assistancecommitments.

Airports

Contracting Agencies

Most airports in the Philippines are owned by either the Department of Transport (DOTr) through executive agencies such as the Manila International Airport Authority or the Civil Aviation Authority of the Philippines. However, DOTr is identified as the implementing agency for most airport projects in NEDA’s Revised List of Infrastructure Flagship Projects (published on 17 February 2020).1

- 1The Civil Aviation Authority of the Philippines (CAAP) was the concession authority for the Caticlan Airport Development Project. The DOTr and the Mactan–Cebu International Airport Authority (MCIAA) offered the concession for the Mactan–Cebu International Airport Passenger Terminal Building.

Airports

Sector Laws and Regulations

There are several regulations that have an impact on PPP projects:

- The Association of Southeast Asian Nations (ASEAN) Single Aviation Market was established in January 2015. This policy aims to liberalize the air transport market in ASEAN countries to improve the region’s connectivity and competitiveness, and reduce airfares.The Philippines has withheld Manila airport, the country’s largest, from the ASEAN provisions due to the slot-constrained nature of the airport.1

- The Manila and Cebu airports are subject to slot coordination to manage any spare capacity efficiently. Slots are either allocated by an independent slot coordination body based on a number of allocation rules or, in the case of Cebu, by the Mactan–Cebu International Airport Authority. Slots are usually allocated for each summer and winter season (footnote 1).

- To ensure safe and secure air transport operations, the International Civil Aviation Organization has published a number of regulations that airport operators have to adopt. These regulations set out the physical requirements for any type of civil airport to receive an operating license from the National Civil Aviation Authority, as well as various security measures to safeguard the aviation industry against acts of unlawful interference (footnote 1).

- The local and national police provide policing services to airports. Regulations on security, customs, quarantine, and immigration specify the functions to be undertaken by the state or public authorities (footnote 1).

- 1ADB. 2019. Public–Private Partnership Monitor Second Edition. Manila. https://www.adb.org/sites/default/files/publication/509426/ppp-monitorsecond-edition.pdf

Functions of Airport Sector Regulatory Agencies

Agency Function Department of Transport

- Provides oversight and strategic direction for air transport and for the airports within its control; and serves as avenue for central government funding for its airports

Civil Aviation Authority of the Philippines (CAAP)

- Acts as one of the governing bodies of the aviation industry (by virtue of Republic Act 9497, 2008, An Act Creating the Civil Aviation Authority of the Philippines, Authorizing the Appropriation of Funds thereof, and for Other Purposes, also known as the CAAP Law)

- Regulates compliance to certain International Civil Aviation Organization provisions

- Provides air navigation services; owns and operates some airports; and owns, operates, and maintains air navigation equipment

Civil Aeronautics Board

- Negotiates air traffic rights and supports slot allocation processes

Office of Transportation Security

- Provides human resources for security screening and regulates aviation security

Sources: ADB. 2019. Public–Private Partnership Monitor. Second Edition. Manila. https://www.adb.org/sites/default/files/publication/509426/ppp-monitor-second-edition.pdf; Government of the Philippines. Official Gazette. Republic Act No. 9497.

https://www.officialgazette.gov.ph/2008/03/04/republic-act-no-9497/Foreign Investment Restrictions

Parameter 2017 2018 2019 Maximum allowed foreign ownership of equity in greenfield projects 40% 40% 40% LEARN MOREAirports

Sector Laws and Regulations

The maximum equity investment allowed for foreign investors in greenfield projects is 40%.1

- 1Government Procurement Policy Board. Republic Act 7718. An Act Authorizing the Financing, Construction, Operation and Maintenance of Infrastructure Projects by the Private Sector, and for Other Purposes. Manila. https://www.gppb.gov.ph/laws/laws/RA_6957.pdf).

Airports

Sector Master Plan

The airports sector does not have a sector-specific master plan.

Priority PPP Airport Projects

No. Project Name Implementing Agency Estimated project cost Status ($ million) (₱ billion) 1. Clark International Airport Expansion Project Phase 1a DOTr/BCDA 296 14.97 Ongoing implementation 2. New Manila International Airport DOTr 14,521 735.63 Awarded 3. Ninoy Aquino International Airport DOTr 2,016 102.12 To commence construction in 6 to 8 months 4. Bacolod–Silay International Airport DOTr 400 20.26 Advanced stages of government approval 5. Iloilo International Airport DOTr 91 4.59 Advanced stages of government approval 6. New Bohol (Panglao) International Airport DOTr 75 3.79 To commence construction in 6 to 8 months 7. Kalibo International Airport DOTr 76 3.84 Under preparation 8. Laguindingan Airport DOTr 903 45.75 Under preparation 9. Davao International Airport DOTr 967 48.97 Under preparation - aThe BCDA engages in PPPs to push forward vital public infrastructure such as tollways, airports, seaports, and major real estate developments.

BCDA = Bases Conversion and Development Authority, DOTr = Department of Transportation.

Note: ₱1 = $0.01974.

Source: National Economic Development Authority. 2020. Revised List of Infrastructure Flagship Projects. Manila. https://www.neda.gov.ph/infrastructure-flagship-projects/.

Projects under Preparation and Procurement

Airports Public-Private Partnerships under Preparation and Procurement

LEARN MOREAirports

Sector Master Plan

The Public–Private Partnership Center tracks the progress of a pipeline of PPP projects in the Philippines, which is updated regularly and published on the PPP Center website.

PPP Airport Projects under Preparation

No. Project Implementing Agency Estimated Total Investment ($ million) (₱ billion) 1. 50-year Integrated Development Plan for Mactan Cebu International Airport (MCIA) Project Department of Transportation 3,169 160.56 2. Davao International Airport Development, Operation, and Management Department of Transportation 963 48.8 3. O&M and Facility Upgrade of Kalibo International Airport Department of Transportation 76 3.84 4. Upgrade, Expansion, Operations and Maintenance of Laguindingan Airport Department of Transportation 843 42.7 O&M = operation and maintenance.

Note: ₱1 = $0.01974.

Source: Public–Private Partnership Center. List of Projects. https://ppp.gov.ph/list-of-projects/ (accessed 28 August 2020); Public– Private Partnership Center. 2019. Investment Opportunities. Manila. https://ppp.gov.ph/investors-corner/investment-opportunities-2/.

PPP Airport Projects under Procurement

No. Project Implementing Agency Estimated Total Investment ($ million) (₱ billion) 1. Sangley Point International Airport Phase 1 Department of Transportation 505 25.450 2. New Bohol (Panglao) Airport Privatization Department of Transportation 4,000 201.480 Source: Public–Private Partnership Center. List of Projects. https://ppp.gov.ph/list-of-projects/ (accessed 28 August 2020); Public– Private Partnership Center. 2019. Investment Opportunities. Manila. https://ppp.gov.ph/investors-corner/investment-opportunities-2/.

Source: Public–Private Partnership Center. List of Projects. https://ppp.gov.ph/list-of-projects/ (accessed 28 August 2020);

Public–Private Partnership Center. 2019. Investment Opportunities. Manila. https://ppp.gov.ph/investors-corner/investmentopportunities-2/.Airports

Features of Past PPP Projects

Procurement of PPP Projects

Airports Public-Private Partnerships procured through various modes

Note: Only active projects are considered in the above graph.

Source: ADB, World Bank. Infrastructure Finance, PPPs and Guarantees. Country Snapshots. Philippines. https://ppi.worldbank.org/en/snapshots/country/philippines (accessed 28 August 2020).

PPP Projects Reaching Financial Close

Airports Public-Private Partnerships reaching Financial Close

Note: Only active projects are considered in the above graph.

Source: ADB, World Bank. Infrastructure Finance, PPPs and Guarantees. Country Snapshots. Philippines. https://ppi.worldbank.org/en/snapshots/country/philippines (accessed 28 August 2020).

PPP Projects with Foreign Sponsor Participation

Airports Public-Private Partnerships with Foreign Sponsor Participation

Note: Only active projects are considered in the above graph.

Source: ADB, World Bank. Infrastructure Finance, PPPs and Guarantees. Country Snapshots. Philippines. https://ppi.worldbank.org/en/snapshots/country/philippines (accessed 28 August 2020).

Government Support to PPP Projects

Government Support for Airports Public-Private Partnerships

Note: Only active projects are considered in the above graph.

Source: ADB, World Bank. Infrastructure Finance, PPPs and Guarantees. Country Snapshots. Philippines. https://ppi.worldbank.org/en/snapshots/country/philippines (accessed 28 August 2020).

Payment Mechanism for PPP Projects

Payment Mechanisms for Airports Public-Private Partnerships

Note: Only active projects are considered in the above graph.

Source: ADB, World Bank. Infrastructure Finance, PPPs and Guarantees. Country Snapshots. Philippines. https://ppi.worldbank.org/en/snapshots/country/philippines (accessed 28 August 2020).

Financing Details

Parameter 1990-2017 1990-2018 1990-2019 PPP projects with foreign lending participation 0 0 0 PPP projects that received export credit agency/international financing institution support 1 1 2 Typical debt:equity ratio 80:20 Time for financial closure UA Typical concession period UA Typical Financial Internal Rate of Return UA - UA = Unavailable

LEARN MOREAirports

Features of Past PPP Projects

The Mactan–Cebu International Airport received debt financing from the Asian Development Bank, while the Clark International Airport (operations and maintenance concession) received debt financing from the International Finance Corporation.

Source: ADB, World Bank. Infrastructure Finance, PPPs and Guarantees. Country Snapshots. Philippines. https://ppi.worldbank.org/en/snapshots/country/philippines (accessed 28 August 2020).

Airports

Tariffs

The approach with passenger service charge and ancillary charges tariff setting has been to provide a form of regulation with the government maintaining control via the Mactan–Cebu International Airport Authority. Passenger service charge escalation is also set out with a concession agreement.1

- 1ADB. 2019. Public–Private Partnership Monitor Second Edition. Manila. https://www.adb.org/sites/default/files/publication/509426/ppp-monitorsecond-edition.pdf.

Airports

Challenges

- Restriction on foreign investments (capped at 40% for greenfield projects) limits the competition in the sector, as the controlling stake in the project company belongs to local companies. The government is taking steps to ease the restriction on foreign investment to attract international investors.

- There have been cancellations of PPP tenders (five in 2017) in the past. The Revised List of Priority Projects indicates that most PPP airport projects were sought to be procured through unsolicited proposals. Furthermore, these projects have not been prepared or structured by the public sector which may result in commercially unviable development propositions.1

- 1ADB. 2019. Public–Private Partnership Monitor Second Edition. Manila. https://www.adb.org/sites/default/files/publication/509426/ppp-monitorsecond-edition.pdf.

-

Energy

-

Power Consumption

699.2 kWh per capita

-

Share of Clean Energy

27.45 %

-

Electricity Access

94.86 %

-

Energy Imports

45.77 %

-

Number of PPPs Reaching FC

68

-

Value of PPPs Reaching FC

$ 25,471 M

-

Number of PPPs with Foreign Sponsors

28

-

Number of PPPs with Govt. Support

55

FC = financial closure, Govt. = government, kWh = kilowatt-hour, M = million.

Note: Share of clean energy and energy imports as percentage of total energy use. Energy access as percentage of total population.

Sources: The Economist Intelligence Unit. Philippines. https://infrascope.eiu.com/; The Global Economy. Share of Clean Energy—Country Rankings. https://www.theglobaleconomy.com/rankings/share_of_clean_energy/; World Bank. Access to Electricity. https://data.worldbank.org/indicator/eg.elc.accs.zs?end=2018&locations=mm-kh-uz-cn-bd-ge-in-id-kzpk-ph-lk-th-vn&start=2018&view=bar; Doing Business. Getting Electricity.https://www.doingbusiness.org/en/data/doingbusiness-score?topic=getting-electricity; The Global Economy. Energy Imports. https://www.theglobaleconomy.com/rankings/energy_imports/; ADB. Cumulative Lending, Grant, and Technical Assistance Commitments. https://data.adb.org/dataset/cumulative-lending-grant-and-technical-assistance-commitments

Energy

Contracting Agencies

The Energy Regulatory Commission (ERC) is an independent body responsible for regulating the power industry. It is also responsible for approving bilateral power supply agreements and Ancillary Service Procurement Agreements, and for setting the distribution wheeling rates of distribution utilities and electric cooperatives.1

- 1ADB. 2018. Energy Sector Assessment, Strategy, and Road Map--Philippines. https://www.adb.org/sites/default/files/publication/463306/philippinesenergy-assessment-strategy-road-map.pdf.

Energy

Sector Laws and Regulations

The Department of Energy (DOE) and various agencies and companies are in charge of the transmission and distribution network. The National Grid Corporation of the Philippines is a privately owned corporation that has been in charge of operating, maintaining, and developing the country’s state-owned power grid since 2007. There is a mix of long-term bilateral contracts (80%) and wholesale electricity spot market contracts (20%). Contracts vary from 5 to 25 years in length. Manila Electric Company (Meralco) is the largest off-taker, covering 25% of population. Power distribution outside the Metro Manila area is handled by private distribution utilities and electric cooperative.1

The Electric Power Industry Reform Act (EPIRA), passed in 2001, is the main foundation of regulation in the energy sector.

Privatization played an essential role in the EPIRA-driven reform process, which established that power generation should no longer be considered a public utility operation.By the end of 2013, the power sector in the Philippines had become one of the most extensively privatized power sectors in the Asia and Pacific region (footnote 1).

The Renewable Energy Act 2008 (Republic Act 9513) lays down various policies for the development of renewable sources of energy. A feed-in tariff provision allows renewable energy generators to secure a guaranteed market and a guaranteed price for their power, in addition to tax credits for developers and value-added tax and duty-free importation of renewable technologies.2

The EPIRA also required the distribution utilities to procure power in the “least-cost manner” for sale to their franchised captive customers, and mandated the establishment of a sophisticated Wholesale Electricity Spot Market (WESM). The WESM, established in 2006, is operated by the Philippine Electricity Market Corporation (footnote 1).

The Energy Virtual One-Stop Shop (EVOSS) Act 2019 (Republic Act 11234) was implemented to establish the EVOSS under the supervision of the DOE. The prospective developers can use the EVOSS online paperless platform to apply, monitor, and receive all the needed permits and applications; submit all the documentary requirements; and pay for charges and fees. The EVOSS platform serves as a decision-making portal for approval of new projects in the energy sector. The portal also accepts the submissions of all the required data and information and undertakes synchronous processing of the data/information.

The law applies to new power projects in generation, transmission, or distribution projects.

- 1ADB. 2018. Energy Sector Assessment, Strategy, and Road Map. Philippines. https://www.adb.org/sites/default/files/publication/463306/philippinesenergy-assessment-strategy-road-map.pdf

- 2Clean Energy Solutions. Home. http://cleanenergysolutions.org/.

Energy Sector Regulatory Authorities in the Philippines

Agency Function Department of Energy (DOE) Formulates and implements all government policies and programs for energy exploration, development, distribution, and conservation to ensure sustainable, secure, reliable, and accessible energy. It is the government’s supervisory arm for all energy sector-related initiatives. Energy Regulatory Commission An independent commission comprised of five members, nominated by the President of the Philippines, to regulate all sectors of the electricity market and protect consumer interests. It promulgates the policies created by the Department of Energy and the guidelines formulated by the Joint Congressional Power Commission; issues licenses to electricity suppliers; and ensures compliance with the power sector laws. It is also responsible for setting the transmission, distribution, and retail fees charged to end users. National Power Corporation (NPC) Prior to the deregulation of the power industry by the Electric Power Industry Reform Act in 2001, the NPC was the largest electric power company in the Philippines. Most of the NPC’s generation assets have been privatized. National Transmission Corporation (TransCo) A state-owned enterprise which has taken over the transmission function and related assets of the NPC. TransCo is now responsible for linking the power plants, owned by both the NPC and independent power producers, to the distribution utilities and electricity cooperatives which, in turn, provide electricity to end users. Power Sector Asset and Liabilities Management Created to privatize and liquidate the NPC’s assets and independent power producers’ contracts and liabilities. It also assumes the ownership of TransCo along with all its debt obligations and oversees the transfer of control of its transmission assets through a 25-year concession agreement to private parties. The Power Sector Asset and Liabilities Management has a 25-year corporate life (by 2026), at the end of which, its assets and liabilities would be transferred to the Government of the Philippines. Energy Investment Coordinating Council Established by Executive Order 30 on 28 June 2017 (Creating the Energy Investment Coordinating Council in order to Streamline the Regulatory Procedures Affecting Energy Projects). The Energy Investment Coordinating Council is mandated to coordinate and facilitate energy investments in the energy sector. Philippine Competition Commission Mandated to promote free and fair competition across all sectors, including energy. The Philippine Competition Commission penalizes monopolistic and anticompetitive behavior, and has the authority to approve asset transactions in the power sector. Philippine Electricity Market Corporation (PEMC) A nonprofit entity that reports administratively to the DOE and has the mandate to manage the Wholesale Electricity Spot Market. The PEMC produces the hourly generation schedules (based on generator market offers), which the system operator then uses to instruct the dispatch of the generation plants. Source: ADB. 2019. Public–Private Partnership Monitor. Second Edition. Manila. https://www.adb.org/sites/default/files/publication/509426/ppp-monitor-second-edition.pdf.

Foreign Investment Restrictions

Business Activity Maximum % of FDI Allowed (2017) Maximum % of FDI Allowed (2018) Maximum % of FDI Allowed (2019) Power generation 100% 100% 100% Power generation (renewable energy, except geothermal which can be up to 100% based on regulations) 40% 40% 40% Power transmission 40% 40% 40% Power distribution 40% 40% 40% Oil and gas 40% 40% 40% FDI = foreign direct investment.

Standard Contracts

Type of Contract Availability PPP/concession agreement Power purchase agreement Capacity take-or-pay contract Fuel supply agreement Transmission and use of system agreement Performance-based operation and maintenance contract Engineering, procurement, and construction contract - No

- Unavailable

Energy

Sector Master Plan

The Department of Energy has developed the Philippine Energy Plan (PEP) 2017–2040 in line with the Ambisyon Natin (Our Ambition) 2040. The plan sets the following targets:

- 100% electrification by 2022;

- additional capacity of 43.765 gigawatts (GW), from the 2016 base capacity of 21.424 GW;

- additional 20 GW of renewable power capacity (from 6.96 GW capacity in 2016);1

- increased reserves and production of local oil, gas, and coal;

- delivery of quality, reliable, affordable, and secure power supply;

- expanded access to electricity;

- transparent and fair power sector playing field;

- establishment of a world-class and investment-driven natural gas industry; and

- stable energy supply through a technologically responsive energy sector.

- 1Government of the Philippines, Department of Energy. 2017. Power Development Plan and Status of Renewable and Fossil-Based Power Sources. Manila. http://erdt.coe.upd.edu.ph/images/congress/6thERDTCongress/01_Nuclear%20Energy%20Forum_Aug%2018%20no%20script.pdf

Projects under Preparation and Procurement

Energy Public-Private Partnerships under Preparation and Procurement

LEARN MOREEnergy

Sector Master Plan

The Public–Private Partnership Center tracks the progress of a pipeline of PPP projects in the Philippines, which is updated regularly and published on the PPP Center website.

PPP Energy Projects

No. Project Implementing Agency Estimated Total Investment 1 Angat Hydroelectric Power Plant (AHEPP) Project Rehabilitation, Operation and Maintenance of Auxiliary #4 and #5 Department of Energy To be decided Source: Public–Private Partnership Center. List of Projects. https://ppp.gov.ph/list-of-projects/ (accessed 28 August 2020); Public– Private Partnership Center. 2019. Investment Opportunities. Manila. https://ppp.gov.ph/investors-corner/investment-opportunities-2/.

Source: Public–Private Partnership Center. List of Projects. https://ppp.gov.ph/list-of-projects/ (accessed 28 August 2020);

Public–Private Partnership Center. 2019. Investment Opportunities. Manila. https://ppp.gov.ph/investors-corner/investmentopportunities-2/.Energy

Features of Past PPP Projects

Procurement of PPP Projects

Energy Public-Private Partnerships procured through various modes

Note: Only active projects are considered in the above graph.

Source: ADB, World Bank. Infrastructure Finance, PPPs and Guarantees. Country Snapshots. Philippines. https://ppi.worldbank.org/en/snapshots/country/philippines (accessed 28 August 2020).

PPP Projects Reaching Financial Close

Energy Public-Private Partnerships reaching Financial Close

Note: Only active projects are considered in the above graph.

Source: ADB, World Bank. Infrastructure Finance, PPPs and Guarantees. Country Snapshots. Philippines. https://ppi.worldbank.org/en/snapshots/country/philippines (accessed 28 August 2020).

PPP Projects with Foreign Sponsor Participation

Energy Public-Private Partnerships with Foreign Sponsor Participation

Note: Only active projects are considered in the above graph.

Source: ADB, World Bank. Infrastructure Finance, PPPs and Guarantees. Country Snapshots. Philippines. https://ppi.worldbank.org/en/snapshots/country/philippines (accessed 28 August 2020).

Government Support to PPP Projects

Government Support for Energy Public-Private Partnerships

Note: Only active projects are considered in the above graph.

Source: ADB, World Bank. Infrastructure Finance, PPPs and Guarantees. Country Snapshots. Philippines. https://ppi.worldbank.org/en/snapshots/country/philippines (accessed 28 August 2020).

Payment Mechanism for PPP Projects

Payment Mechanisms for Energy Public-Private Partnerships

Note: Only active projects are considered in the above graph. User charges include wholesale and sale toward Power Purchase

Agreements or transmission fees to private entities.Source: ADB, World Bank. Infrastructure Finance, PPPs and Guarantees. Country Snapshots. Philippines. https://ppi.worldbank.org/en/snapshots/country/philippines (accessed 28 August 2020).

Typical Risk Allocation for PPP Projects

Risk Category Private Public Shared Comments Demand risk Revenue collection risk Tariff risk Government payment risk Environmental and social risk Land acquisition risk Permits Handover risk Political risk Regulatory risk Interconnection risk Brownfield risk: asset condition Grid performance risk Hydrology risk Exploration and drilling risk - Yes

Financing Details

Parameter 1990–2017 1990–2018 1990–2019 PPP projects with foreign lending participation

14

14

14

PPP projects that received export credit agency/international financing institution support

13

13

13

Typical debt:equity ratio

UA UA UA Time for financial closure

UA Typical concession period

20–25 years

Typical Financial Internal Rate of Return

UA - UA = Unavailable

Source: ADB, World Bank. Infrastructure Finance, PPPs and Guarantees. Country Snapshots. Philippines. https://ppi.worldbank.org/en/snapshots/country/philippines (accessed 28 August 2020).

Energy

Tariffs

The feed-in-tariff (FIT) support applies to renewable energy projects—hydro, wind, solar, ocean, and biomass. To be eligible for a FIT, power utilities must receive a Certificate of Compliance from the ERC.

Under the FIT, generators with eligible renewable energy capacity are paid a FIT rate that is guaranteed for 20 years from the date of effectivity. Funding of the FIT rate for which renewable energy generators are paid comprises two interacting components: (i) a cost recovery rate based on the prevailing WESM price, and (ii) a universal subsidy known as the FIT-All paid by end users and set annually.1

The tariff system is financed by a fixed charge on electricity bills referred to as the Feed-In-Tariff Allowance (FIT-ALL). The FIT-ALL Fund, administered by the National Grid Corporation of the Philippines, is then redistributed to eligible renewable energy developers. The FIT decreases over time, according to fixed digression rates, to mirror progressive drops in cost of technologies.2

- 1ADB. 2018. Energy Sector Assessment, Strategy, and Road Map. Philippines.https://www.adb.org/sites/default/files/publication/463306/philippinesenergy-assessment-strategy-road-map.pdf.

- 2IEA. Feed-in Tariff Rules. http://www.iea.org/policies/4805-feed-in-tariff-rules.

Feed-In-Tariffs

Technology Feed-In-Tariff (₱/kwh) Signed Renewable Energy Payment Agreement (REPA) Effective Renewable Energy Payment Agreement (REPA) as of 5 September 2018 Number Capacity (mw) Number Capacity (mw) Solar 24 525.95 23 484.65 FIT 1: 9.68 7 108.90 6 67.60 FIT 2: 8.69 17 417.05 17 417.05 Wind 7 426.90 7 426.90 FIT 1: 8.53 3 249.90 3 249.90 FIT 2: 7.40 3 144.00 3 144.00 Bangui 1 and 2: 5.96 1 33.00 1 33.00 Hydro 7 45.50 6 43.10 FIT 1: 5.9 5 34.60 5 34.60 Digression Rate: 5.8705 2 10.90 1 8.50 Biomass 19 138.13 16 131.63 FIT 1: 6.63 14 121.56 12 117.06 Digression Rate: 6.5969 5 16.56 4 14.56 Total 57 1,136.48 52 1,086.28 FIT = feed-in-tariff.

Source: National Transmission Corporation (Transco). 2018 and 2019. Feed-In-Tariff Allowance Rate Application. ERC Case No. 2018-085. RC Expository Presentation. Manila. https://www.transco.ph/downloads/fitall/2019FIT-AllRateExpositoryPresentation-Davao.pdf.

Energy

Challenges

- Planning of the power system requires improvement as the country’s needs are not always addressed because of constraints in the transmission system and overcapacity in some areas.

- Project developers face challenges in obtaining funding, as lenders generally seek payment guarantees from the government off-takers.

- The variable nature of renewable energy technologies presents additional challenges in managing the stability of the Philippine grid and in securing a reliable supply of energy, particularly when amplified through geographic concentration such as in Negros.1

- Effectiveness of the Energy Virtual One-Stop Shop (EVOSS) system is critical to harmonize the procedures in obtaining permits and licenses.

- 1ADB. 2019. Public–Private Partnership Monitor Second Edition. Manila. https://www.adb.org/sites/default/files/publication/509426/ppp-monitorsecond-edition.pdf

-

Water and Wastewater

-

Access to Water

82.8 %

-

Access to Sanitation

93.7 %

-

Number of PPPs Reaching FC

9

-

Value of PPPs Reaching FC

$ 4,271 M

-

Number of PPPs with Foreign Sponsors

3

-

Number of PPPs with Govt. Support

2

FC = financial closure, Govt. = government, M = million.

Note: Access to water and sanitation as percentage of total population with access to improved water resources and sanitation facilities.

Sources: ADB. 2018. Philippines, 2018–2023 — High and Inclusive Growth. Philippines. https://www.adb.org/sites/default/files/institutional-document/456476/cps-phi-2018-2023.pdf; The Economist Intelligence Unit. Philippines. https://infrascope.eiu.com/; ADB. Cumulative Lending, Grant, and Technical Assistance Commitments. https://data.adb.org/dataset/cumulative-lending-grantand-technical-assistance-commitments

Water and Wastewater

Contracting Agencies

The institutional arrangement for the water and sanitation (wastewater) sector in the Philippines has been complicated with overlaps between the executive, regulatory, and service provision functions. There is no central organization tasked to oversee the operations of the entire water supply and sanitation system. The entities/institutions providing water supply and sanitation services that may act as contracting agencies for PPP water and sanitation projects include the following:

- Government-owned and controlled corporations (GOCCs) Water supply and sanitation (WSS) service providers classified as GOCCs include:

- Water districts that operate and maintain water supply systems in one or more provincial cities or municipalities.

- Metropolitan Waterworks and Sewerage System (MWSS) created to provide WSS services in the National Capital Region or the Metropolitan Manila, including parts of the selected municipalities of the provinces of Rizal, Cavite, and Bulacan that have no water districts.

- Tourism Infrastructure and Enterprise Zone Authority (TIEZA) provides WSS in tourist destinations declared as tourist zone, which include Boracay Island, Tagaytay, and Balicasag Island, among others.

- Local government units (LGUs) responsible for the provision of WSS services, as mandated in the Local Government Code.

The GOCCs and LGUs usually operate Level III (piped water supply systems), and for Level III WSS PPPs, the contracting agencies are either GOCCs or LGUs.

- Community-based organizations (CBOs) responsible for providing WSS services in small urban and rural areas.

CBOs usually operate Level I (non-piped water systems) or Level II (shared connection pipe system) water supply systems with support from national governments or nongovernment organizations. For Levels I and II WSS PPPs, the contracting agencies are the CBOs.

Source: World Bank. 2016. Private Sector Provision of Water and Sanitation Services in Rural Areas and Small Towns: The Role of the Public Sector—Philippines. https://www.wsp.org/sites/wsp/files/publications/WSP%20SPI%20Country%20Report%20-%20Philippines%20final.pdf.

- Government-owned and controlled corporations (GOCCs) Water supply and sanitation (WSS) service providers classified as GOCCs include:

Water and Wastewater

Sector Laws and Regulations

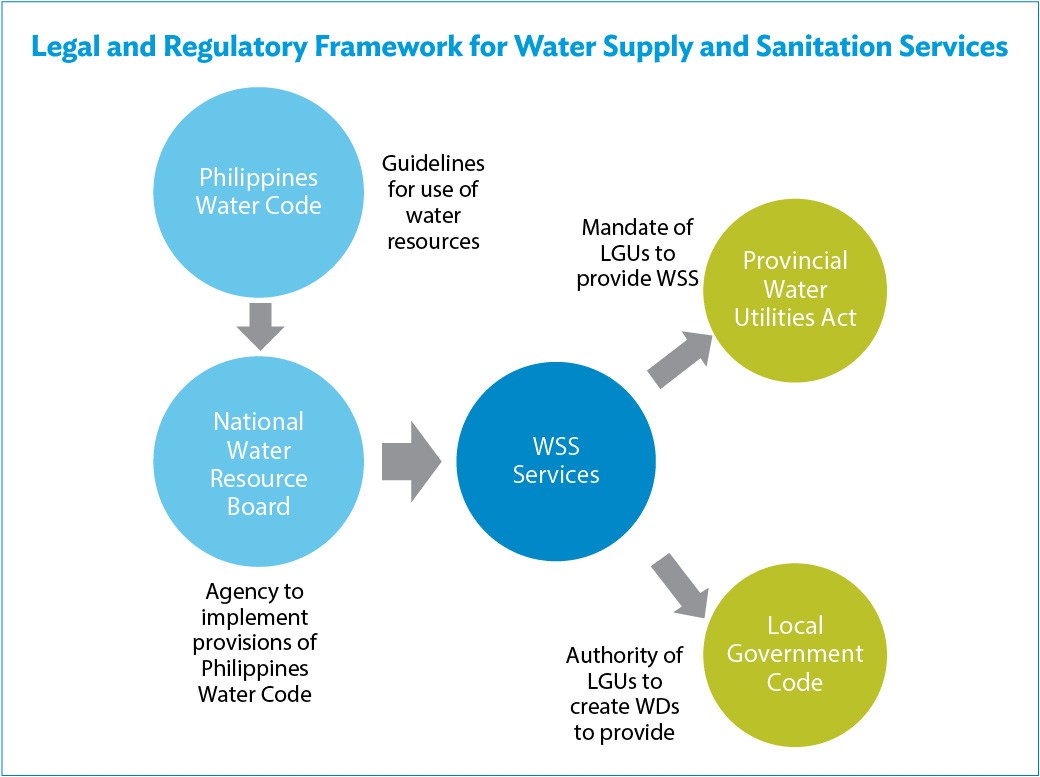

Originally, water supply and sanitation (WSS) services in the Philippines were governed through a centralized system, which have been decentralized over the years through various government initiatives:

WSS = water supply and sanitation.

Source: World Bank. 2016. Private Sector Provision of Water and Sanitation Services in Rural Areas and Small Towns: The Role of the Public Sector. Philippines.https://www.wsp.org/sites/wsp/files/publications/WSP%20SPI%20Country%20Report%20-%20Philippines%20final.pdf.

Parameter 2017 2018 2019 Can the private sector be given water abstraction rights? Are there regulations in place on raw water extraction? Are there regulations in place on the release of treated effluents? - = Yes

Source: World Bank. 2016. Private Sector Provision of Water and Sanitation Services in Rural Areas and Small Towns: The Role of the Public Sector—Philippines. https://www.wsp.org/sites/wsp/files/publications/WSP%20SPI%20Country%20Report%20-%20Philippines%20final.pdf

The executive functions, such as policy formulation and general support to the sector in terms of financial and technical support, capacity building, and monitoring, are performed by the Department of the Interior and Local Government (DILG), the Department of Public Works and Highway (DPWH), the Department of Environment and Natural Resources (DENR), and the Department of Health (DOH).

The regulatory functions, such as issuing licenses or permits to abstract water or to operate a WSS system, and review and approvals of tariffs, are performed by the Local Water Utilities Administration (LWUA), the National Water Resources Board (NWRB), and the Metropolitan Waterworks and Sewerage Systems (MWSS). The Local Government Code allows self-regulation for the LGUs.1

- 1World Bank. 2016. Private Sector Provision of Water and Sanitation Services in Rural Areas and Small Towns: The Role of the Public Sector. Philippines. https://www.wsp.org/sites/wsp/files/publications/WSP%20SPI%20Country%20Report%20-%20Philippines%20final.pdf.

Institutions Performing Executive and Regulatory Functions in the Water and Wastewater Sector

Agency Mandate Functions Institutions performing executive functions Department of the Interior and Local Government (DILG) Strengthen local governments capability in effective delivery of basic services to the community Within the organizational structure of the DILG is the Water Supply and Sanitation Program Management Office, under the Office of Project Development Services. Its main responsibility is to support the provision of water supply and sanitation services by the local government units (LGUs). The DILG defines and enforces quality and performance standards for the LGU-operated water system. However, the LGUs retain the responsibilities for planning, financing, and regulating the water supply. Department of Public Works and Highway (DPWH) Undertake the planning of infrastructure, including water resources projects and other public works, and the design, construction, and maintenance of national roads and bridges, and major flood control systems. The DPWH is the umbrella department for the Local Water Utilities Administration (LWUA). The department acts as the lead agency for an inter-agency committee to develop a water resources sector master plan that will effectively address issues and challenges in the water sector in the country. The DPWH also provides support for the improvement of LGU-operated water supply and sanitation system by developing additional water sources to increase the supply capacity in the rural areas, in particular the Level II system (shared connection pipe system). Department of Environment and Natural Resources (DENR) Govern and supervise the exploration, development, utilization, and conservation of the country’s natural resources. The DENR’s primary role in the water supply and sanitation sector is to monitor effluent from the wastewater/septage treatment plants prior to its disposal to natural waterways, like rivers, lake, and artificial impounding water. The DENR also sets the monitoring parameters and effluent standards that water supply and sanitation service providers must comply with. Department of Health (DOH) Ensure access to public health services through the provision of quality health care, and the regulation of all health services and products. In general, the DOH provides leadership and capacity building in health services and administers specific services. The DOH develops national plans, technical standards, and guidelines on health. It also regulates all health services and products and provides special tertiary health-care services and technical assistance to health providers and stakeholders. For the water supply and sanitation sector, the DOH provides facilities to monitor and regulate the water quality being distributed to all water consumers by the water and sanitation service provider, and enforces the Philippine National Standards for Drinking Water (PNSDW). Institutions performing regulatory functions National Water Resources Board (NWRB) Ensure the optimum exploitation, utilization, development, conservation, and protection of the country’s water resource, consistent with the principles of Integrated Water Resource Management. The NWRB is the main regulatory agency for the water sector. Its regulatory functions include the issuance of water permits for the appropriation and use of water, and the adjudication of disputes regarding the use of water.

In terms of economic regulation, the NWRB is tasked to regulate (review and approve) water supply tariffs charged by private operators and private service providers. The NWRB’s authority to approve and review the water districts’ tariffs was transferred to the LWUA.

The NWRB is also responsible for the issuance of Certificate of Public Convenience and Certificate of Public Convenience and Necessity—the permits to provide public services to any private water operators.

Local Water Utilities Administration (LWUA) Promote and oversee the development of water supply systems in provincial cities and municipalities outside of Metropolitan Manila, and review tariff proposals from water districts The LWUA is a government-owned and controlled corporation with a specialized lending function to the water districts. It allocates and re-lends the funds to water districts at competitive terms. Some funds are extended as grants. Under recent enhancements to its charter, the LWUA has been tasked to assist water districts graduate into creditworthy status and access nontraditional sources of funds.

The LWUA regulates water districts in terms of tariff setting (including publishing a guideline on how to calculate tariffs, and reviewing and approving tariffs); establish and monitor key performance indicators and business efficiency measures, such as service coverage and collection efficiency; and regulates the prevailing pressure in the distribution system, the Non-Revenue Water. It also provides institutional development assistance in the form of advisory and managerial services, and transfers policy-making, managerial, and technical competence to water districts.

Metropolitan Waterworks and Sewerage Systems (MWSS) Ensure an uninterrupted and adequate supply and distribution of potable water for domestic and other purposes and the proper operation and maintenance of sewerage systems in Metro Manila and parts of the provinces of Cavite, Rizal, and Bulacan. The MWSS has transferred the operation and management of the entire water supply and sewerage system for 25 years to its two water concessionaires in the east and west zones of Metropolitan Manila.

The MWSS Regulatory Office (MWSS-RO) is a separate unit within MWSS tasked with regulating the two concessionaires through contracts.

The regulatory functions performed by the MWSS-RO includes tariff reviews and approvals, and performance monitoring in accordance to the contract terms.

Source: World Bank. 2016. Private Sector Provision of Water and Sanitation Services in Rural Areas and Small Towns: The Role of the Public Sector—Philippines. https://www.wsp.org/sites/wsp/files/publications/WSP%20SPI%20Country%20Report%20-%20Philippines%20final.pdf

Foreign Investment Restrictions

Parameter 2017 2018 2019 Maximum allowed foreign ownership of equity in greenfield projects Bulk water supply and treatment

40% 40% 40% Water distribution

40% 40% 40% Wastewater treatment

40% 40% 40% Wastewater collection

40% 40% 40% LEARN MOREWater and Wastewater

Sector Laws and Regulations

The maximum equity investment allowed for foreign investors in greenfield projects is 40%.1

- 1Government Procurement Policy Board. Republic Act 7718. An Act Authorizing the Financing, Construction, Operation and Maintenance of Infrastructure Projects by the Private Sector, and for Other Purposes. Manila. https://www.gppb.gov.ph/laws/laws/RA_6957.pdf.

Standard Contracts

Type of Contract Availability PPP/concession agreement Bulk water supply agreement Performance-based operation and maintenance contract Engineering, procurement, and construction contract - No