Overview

Number of PPPs and Investment in PPPs

-

PPP Investment

$ 6,758 M -

Number of PPPs Reaching FC

---- -

Value of PPPs Reaching FC

----

Revenue Model and Government Support to PPPs

-

Number of PPPs with Govt. Support

---- -

Number of User Charge PPPs

---- -

Number of Govt. Pay PPPs

----

PPPs under Preparation and Procurement

-

Number of PPPs under Preparation

---- -

Number of PPPs under Procurement

----

FC = financial closure, Govt. = government, M = million.

Source: World Bank. Infrastructure Finance, PPPs and Guarantees. Country Snapshots. Pakistan. https://ppi.worldbank.org/en/snapshots/country/pakistan (accessed 1 September 2020).

The public–private partnership (PPP) regulation in Pakistan is one of the government processes that shifted to the provincial level. As a result, the provincial governments have the primary responsibility of developing and implementing their own PPP policies and legislation. In this regard, the provincial governments of Punjab, Sindh, and Pakhtunkhwa have initiated key developments with respect to their individual PPP jurisdictions.1

- Establishment of a PPP policy and law in the Province of Punjab. The Punjab PPP Cell was initiated to support and develop the regulatory framework for PPPs within the province. The PPP Steering Committee, established by the provincial government of Punjab through notification, is the competent authority to approve, reject, or send back for reconsideration the PPP project proposals submitted by government agencies. As per the Punjab PPP Act 2019, the provincial government of Punjab shall establish the Public Private Partnership Authority (PPPA) that is responsible for implementing all the provisions of the act, while the PPP Cell shall provide administrative and secretarial support to the board.

- Establishment of a PPP policy and law in the Province of Sindh. The Sindh PPP unit was established with the primary function of enhancing the development of PPPs in the province.

- Establishment of a PPP law and framework in the Province of Khyber Pakhtunkhwa. The PPP legal framework of the province was developed and governed by the Khyber Pakhtunkhwa PPA Act. At the end of 2020, the Khyber Pakhtunkhwa PPP Act 2020 was passed, amending the 2017 PPP Act, to support a more enabling regulatory environment for PPPs in the province.

At the federal level, Pakistan did not have a PPP legislation until March 2017 when the Public Private Partnership Authority Act of 2017 (the Federal PPPA Act) was passed by the Parliament. Prior to the Federal PPP Act, private sector participation in infrastructure was propagated by the Pakistan Policy on Public Private Partnerships of 2010 (the 2010 PPP Policy). The 2010 PPP Policy detailed a set of guidelines for PPP development and the regulatory framework required to develop PPP projects. Pursuant to the 2010 PPP Policy, a statutory body, the Infrastructure Project Development Facility (IPDF), was established.

Subsequent to the passing of the Federal PPP Act in 2017, the PPPA took that role from the IPDF to further the implementation of PPPs in the federal territory. In July 2020, an ordinance was passed to introduce an amendment to the 2017 PPP Law. In early 2021, the National Assembly approved this amendment, thereby enacting the Public Private Partnership Authority (Amendment) Act 2021 (PPPA Amendment Act 2021).2

- 1Asian Development Bank. 2019. Public–Private Partnership Monitor. Second Edition. Manila. https://www.adb.org/sites/default/files/publication/509426/ppp-monitorsecond-edition.pdf.

- 2Government of Pakistan, PPPA. Public Private Partnership Authority (Amendment) Act 2021. Islamabad. http://www.senate.gov.pk/uploads/documents/1612419098_271.pdf.

-

National Framework for Enabling PPPs

PPP Legal and Regulatory Framework

Does the country have - National PPP law and PPP regulations? Public financial management laws and regulations? Sector-specific laws and regulations? Procurement laws and regulations? Environmental laws and regulations? Laws and regulations for social compliance? Laws and regulations governing land acquisition and ownership? Taxation laws and regulations? Employment laws and regulations? Licensing requirements? What are the other components of the PPP legal and regulatory framework? PPP policy and guidelines- Yes

- Unavailable

LEARN MORENational Framework for Enabling PPPs

PPP Legal and Regulatory Framework

Overview of Provincial PPP Frameworks in Pakistan

Province Regulatory Framework Punjab Public–Private Partnership

(PPP) LawThe PPP legal framework in Punjab is governed by the Punjab Public Private Partnership Act 2019 (which repealed the Punjab Public Private Partnership Ordinance 2014 and the Punjab Public Private Partnership for Infrastructure Act 2010) and by the Punjab Public Private Partnership Rules 2014 (Punjab PPP Rules). The Punjab PPP Act and Punjab PPP Rules are collectively referred to as Punjab PPP Laws.

In 2019, the provincial government of Punjab issued PPP Ordinance 2019, which was subsequently repealed and replaced by the Punjab Public Private Partnership Act 2019. The government has also issued the Viability Gap Funding (VGF) Guidelines for PPP projects in 2019 that are being revised to incorporate changes in the PPP Act 2019.

Under the Punjab PPP laws, there are identifiable entities (i.e., PPP Authority, PPP Cell, Board of the Authority, Executive Committee, and Risk Management Unit) to prepare, approve, and promote PPPs in the province.Sindh Law The PPP legal framework in Sindh is governed by the Sindh Public Private Partnership Act 2010 (Sindh PPP Act), as amended by the Sindh Public Private Partnership (Amendment) Act 2011 and the Sindh Public Private Partnership (Amendment) Act 2014.

Similar to the Punjab province, Sindh has also amended its PPP Act in 2018 with the Sindh Public Private Partnership (Amendment) Act 2018, but only making certain amendments and modifications to the existing act rather than replacing it. Some of the key amendments include (i) introduction of the PPP Support Facility (PSF) mechanism that would subsume the VGF, effective from January 2022; (ii) detailing the financing elements of the existing act; and (iii) dealing with unsolicited proposals, among others. In Sindh, there are four entities (i.e., PPP Policy Board, PSF, PPP Unit, and PPP Node) responsible for the identification, preparation, and implementation of PPP projects, each having different roles and functions.Khyber Pakhtunkhwa PPP Law The Khyber Pakhtunkhwa Public Private Partnership Act 2020, which amended the 2017 PPP Act, has already been passed by the provincial government in the latter part of 2020 and is currently in its implementation process. (see https://www.pakp.gov.pk/wpcontent/uploads/Public-Private-Partnership-act-2020-Act-No.XLII-of-2020.pdf).

The PPP Act 2020 has simplified the rules and regulations to create a more facilitative and cohesive partnership and to promote the efficient and sustainable delivery of PPP initiatives in the province.

In Khyber Pakhtunkhwa, there are three entities (i.e., PPP Committee, PPP Unit, and PPP Node) responsible for the identification, preparation, and implementation of PPP projects, each having different roles and functions.Balochistan PPP Law Balochistan has not yet developed a provincial PPP legal framework. Furthermore, the Federal PPP Act does not extend to Balochistan since the Federal PPP Act defines PPPs as a commercial transaction between an implementing agency and a private party. Accordingly, Balochistan, being a provincial government, does not fall within the scope of an implementing agency. Source: Asian Development Bank. 2019. Public–Private Partnership Monitor. Second Edition. Manila. https://www.adb.org/sites/default/files/publication/509426/ppp-monitor-second-edition.pdf.

Evolution of PPP Regulation at Federal Level

The federal government through the Ministry of Finance initiated the PPP program in 2006 by establishing the Infrastructure Project Development Facility (IPDF) after obtaining approval of the Prime Minister of Pakistan. The primary mandate of the IPDF was to promote PPPs in Pakistan, along with the provision of advisory and facilitation services for ministries, autonomous bodies, and other government-owned entities (implementing agencies) to develop, structure, and procure PPP projects under a PPP modality.1

For the convenience of the private sector and to govern the role of the IPDF, the federal government approved the PPP Policy in 2007 and then an amendment in 2010. The IPDF continued providing facilitation and advisory services in accordance with the approved policy till 2017. On 30 March 2017, the Parliament passed the Public Private Partnership Authority Act (No. VIII) 2017 (referred to as the act) through which all assets, powers, rights, and authorities of the IPDF were transferred to and vested in the PPPA.

In July 2020, the Government of Pakistan approved an amendment to the existing PPP Act of 2017 with the Public Private Partnership Authority (Amendment) Ordinance 2020. In early 2021, the Parliament approved the amendment, thereby enacting the Public Private Partnership Authority (Amendment) Act 2021. The PPPA Amendment Act 2021 elaborates the preamble, clearly enhancing the role of the act and the PPPA, and aims to

- establish a regulatory framework to execute PPPs in Pakistan so as to promote domestic and foreign private investment in development projects;

- increase the availability of public infrastructure and service delivery, and improve their reliability and quality to accelerate economic growth and achieve the social objectives of the government;

- mobilize private sector resources for financing, construction, and operation and maintenance (O&M) of development projects;

- improve efficiency of management and O&M of development projects in the public sector by introducing modern technologies and management techniques; and

- reduce transaction costs, ensure appropriate regulatory controls, and promote transparency and accountability in carrying out development projects.

Until 2020, the Public Procurement Regulatory Authority (PPRA) Ordinance 2002 was applicable for regulating public procurement of goods, services, and works in the public sector and for overseeing public procurement, which was defined as “acquisition of goods, services, or construction of any works financed wholly or partly out of the Public Fund, unless excluded otherwise by the Federal Government.” This signified that the PPRA Ordinance 2002 and the subsequently issued rules were applicable for PPP projects only in cases “in which the Federal Government and the private party have joint equity or ownership through a corporate body, and procurement is made by such body,” and not to the projects “in which the Federal Government does not have any equity of ownership, and procurement is made by the private party".2 In July 2020, the Government of Pakistan issued a gazette notification amending the PPRA Ordinance 2002 by way of the Public Procurement Regulatory Authority (Amendment) Ordinance 2020.3 One of the significant amendments made to the PPRA Ordinance 2002 is the modification of the definition of public procurement into acquisition of goods, services, or construction of any works financed wholly or partly out of the public fund. The amendment also includes disposal of public assets and commercial transactions between the procuring agency and the private party, in terms of which the private party is allowed to

- perform a procuring agency’s assigned functions, including O&M, on its behalf,

- assume the use of public asset, or

- receive a benefit either from budget or revenue of the federal government or from fees or charges to be collected by the private party for performing the procuring agency’s function or any combination thereof.

Based on the above modification, it is inferred that from July 2020 onward, the PPP project structures, such as management contracts, O&M contracts, and other forms of concessions (partly or fully financed by a public entity) where private sector is involved, shall be guided by the PPRA (Amendment) Ordinance 2020.

- 1Government of Pakistan, PPPA. 2018. Newsletter PPPA. 1 (1). Islamabad. November. https://www.pppa.gov.pk/SiteImage/Misc/files/NewsLetters/Newsletter-2%20Nov%202018%20(Vol%201).pdf.

- 2Government of Pakistan, PPRA. 2015. PPRA Procurement Code. 4th Edition. Islamabad. https://www.ppra.org.pk/doc/code4.pdf.

- 3Government of Pakistan, PPRA. 2020. Public Procurement Regulatory Authority (Amendment) Ordinance, 2020. Islamabad. https://ppra.org.pk/doc/ordinance2020.pdf.

The federal government and the provincial governments of Punjab, Sindh, and Khyber Pakhtunkhwa have each passed dedicated PPP legislation in their respective jurisdictions. PPP legislation in Balochistan is being developed through consultations with key stakeholders. In the federal territory of Pakistan, the Federal PPP Act is applicable to PPPs. The Federal PPP Act established the Public Private Partnership Authority (Federal PPPA), replacing the IPDF. All assets, powers, rights, and authorities of the IPDF were transferred to the PPPA.

National Framework for Enabling PPPs

Types of PPPs

Regulations in Pakistan at the federal level do not specify nor discourage any specific PPP types; it is silent on the PPP types. The provincial PPP regulations, however, identify specific PPP types in their respective laws.

Types of PPPs in the Provinces of Pakistan

Province Type of PPP Punjab Public–Private

Partnership (PPP) LawBuild–transfer, build–lease–transfer, build–operate–transfer, build–own–operate, build– own–operate–transfer, build–transfer–operate, contract–add–operate, develop–operate– transfer, joint venture, management contract, rehabilitate–operate–transfer, rehabilitate– own–operate, and service contract Sindh PPP Law Build–operate–transfer, design–build–finance–operate, and any other variant of PPP. Additionally, the following modes are identified in Part IV of the Sindh Public Procurement Rules 2010: service contract, management contract, lease contract, build–own–operate, build–own–operate-transfer, build–lease–transfer, build–transfer, rehabilitate–operate– transfer, and any combination or variation of the above modes or any other arrangement under PPP mode approved by the Sindh Public Procurement Regulatory Authority. Khyber Pakhtunkhwa PPP

LawBuild–operate–transfer, build–own–operate–transfer, design–build–finance–operate, and any other variant of PPP. Source: Asian Development Bank. 2019. Public–Private Partnership Monitor. Second Edition. Manila. https://www.adb.org/sites/default/files/publication/509426/ppp-monitor-second-edition.pdf.

Service Contracts

Management Contracts

Affermage or Lease Contracts

Design-Bid-Build (DBB)

Design-Build (DB)

Build-Operate-Transfer (BOT)

Design-Build-Finance-Operate-Transfer (DBFOT)

Build-Own-Operate (BOO)

Concessions

Joint Venture

Hybrid Contracts

Others

- Build-Lease-Transfer

- Build-Transfer-Operate

- Contract-Add-Operate

- Develop-Operate-Transfer

- Rehabilitate-Own-Operate (ROO)

LEARN MORENational Framework for Enabling PPPs

Types of PPPs

Given the types of PPP being adopted in the three provinces, it could be construed that, at the federal level, Pakistan allows for all standard forms of PPPs—i.e., build–operate–transfer (BOT), build–own–operate–transfer (BOOT), build–own–operate (BOO), design–build–finance–operate–transfer (DBFOT), management contracts, annuity-based agreements, and operation and maintenance (O&M) agreements.

- BOT user fees, where the private party builds and operates the project assets. The project assets are transferred back to the government contracting agency at the end of the contract period. The private sector entity recovers the investment by way of charging user fees. These user fees are, in most cases, regulated by the government or are predetermined.

- BOT annuity contracts, where the private sector typically builds and operates the project assets during the concession period. However, instead of charging the users directly for the services rendered, in annuity models, the government contracting agency pays the private sector operator availability or annuity payments based on the availability of the services at certain predefined performance standards.

- BOOT, which is similar to BOT with the only difference that the private sector also owns the project assets over the duration of the PPP concession period.

- BOO, which is similar to BOOT with the only difference that the project assets are not transferred back to the government contracting agency at the end of the PPP concession period.

- DBFOT, where the private party is responsible for designing, financing, constructing, operating, and maintaining the project assets. At the end of the concession period, the project assets are transferred back to the government contracting agency. The ownership of the project asset is with the government contracting agency. A variation to this is where the ownership during the project tenure is with the private sector, in which case, it would become a design–build–finance–own–operate–transfer (DBFOOT) contract structure.

- O&M agreements, where the private party would be in charge of O&M of project assets and may also be required to arrange financing.

While the federal regulations are silent on PPP types, the PPP Policy 2010 classifies PPPs based on the types of funding for the projects. As per the PPP Policy 2010, there can be several potential sources of revenue or income depending on the type of PPP project and the likely financial performance of the project. These revenue sources may include the following:1

- Tariff-based PPP projects. In the case of financially viable projects, project revenue is derived solely from user charges and/or tariffs. Initial tariffs and subsequent tariff escalation are initially determined through feasibility studies conducted by contracting agencies to ensure an appropriate or market acceptable rate of return based on an efficient operation. The competitive bidding process will minimize the initial government-estimated tariffs and the subsequent escalation 1 .

- Unitary or annuity type revenue. The government pays the concessionaire for providing the infrastructure and related services either in an agreed fixed amount each year of operation or an amount based on the future situation (e.g., future traffic levels). Such payments can either be linked with user charges or can be independent of them. The project feasibility study will recommend a system of annual unitary payments based solely on outputs (i.e., specific project targets met by the concessionaire)1 .

- Projects requiring subsidy. For projects that have been appraised as not being "bankable" without support, such support may be offered by the Government of Pakistan and can comprise various types and come from various sources. This is to ensure that with such support, the project is ultimately financially viable or bankable and is therefore attractive to the private sector. Any proposed subsidy will be finally determined through competitive bidding to ensure the lowest liability for the government.

- 1 a b c Government of Pakistan, PPPA. 2010. Pakistan Policy on Public Private Partnerships: Private Participation in Infrastructure for Better Public Services.Islamabad. http://www.lcwu.edu.pk/ocd/cfiles/City%20and%20Regional%20Planning/CRP-45/Lec5PPPPolicyFINAL14-May-2010.pdf.

National Framework for Enabling PPPs

Eligible Sectors for PPPs

Regulations at the federal level are silent about any specific sector criteria for undertaking PPPs. However, the PPP Policy of 2010 lists a broad range of sectors, including, but not limited to

- transport and logistics (federal, provincial, and municipal roads; rail, seaports, airports, and fishing harbors; warehousing, wholesale markets, slaughterhouses, and cold storage);

- mass urban public transport (integrated bus systems, intracity and intercity rail systems);

- local government services (water supply and sanitation, solid waste management, low-cost housing, health care and/or education, and skills development facilities);

- energy projects (hydroelectric and captive power generation project, hydro and thermal power generation projects);

- tourism projects (cultural centers, entertainment and recreational facilities, and other tourism-related infrastructure);

- industrial projects (industrial parks, special economic zones, and related projects);

- irrigation projects (some of these are combined with power generation); and

- social infrastructure (education, culture, and health infrastructure).

Road Infrastructure

Main roads, collector roads and local roads, toll roads, toll bridges

Rail and Mass Transit Infrastructure

Railway facilities, urban mass transportation

Waterways Infrastructure

Infrastructure for crossing at sea, river, or lake

Seaport Infrastructure

Port facilities and passengers and cargo terminal Airport infrastructure

Airport Infrastructure

Airport facilities

Logistics Infrastructure

Warehousing, wholesale markets, slaughterhouses, and cold storage

Water Resources and Irrigation Infrastructure

Bulk water carrier pipelines, irrigation networks and water storage infrastructure (including its supporting structures, among others) reservoir, dam, and weir

Water Supply Infrastructure

Raw water unit, production unit, distribution unit

Wastewater Infrastructure

Centralized wastewater management systems including service unit, collection unit, processing unit, final disposal unit, water discharge pipeline, and sanitation Local wastewater management system including local processing unit, transport unit, sludge treatment unit, final disposal unit, water discharge pipeline, and sanitation

Solid Waste Management Infrastructure

Transportation, processing, final waste processing

Telecommunication Infrastructure

Telecommunication network, passive infrastructure such as transmission media cable ducts

IT and Informatics Infrastructure

e-Government infrastructure

Power Generation

Power generation facilities

Power Transmission and Sub-Transmission

Power transmission, and main substation facilities

Power Distribution

Power distribution facilities

Energy Conservation Infrastructure

Education Infrastructure

Education and skills development facilities

Health Infrastructure

Hospital (i.e., hospital building, hospital infrastructure, and medical equipment; basic health service facility, such as building, infrastructure, and medical equipment for health center and/or clinic; health laboratory, such as health laboratory building, health laboratory, infrastructure, and laboratory equipment)

Public Housing

Low-Cost Housing

Government Buildings

Zone Infrastructure

Industrial projects including industrial parks, special economic zones, and related projects

Tourism Infrastructure

Cultural centers, entertainment and recreational facilities, and other tourism-related infrastructure

Gas

Processing, storage, transportation, distribution

Urban Facilities Infrastructure

Land reclamation, Environmental management, Remediation and clean-up and Urban development

Sports, arts, and culture facility infrastructure

Sports recreation facilities

Penitentiary infrastructure

Traditional market

LEARN MORENational Framework for Enabling PPPs

Eligible Sectors for PPPs

PPPs are applied typically across various economic and social infrastructure sectors.

Sectors Subsectors Asset/Facility Type Transportation

infrastructureRoad infrastructure Main roads, collector roads and local roads, toll roads, toll bridges Rail and mass transit infrastructure Railway facilities, urban mass transportation Waterways infrastructure Infrastructure for crossing at sea, river, or lake Seaport infrastructure Port facilities and passengers and cargo terminal Airport infrastructure Airport facilities Logistics infrastructure Warehousing, wholesale markets, slaughterhouses, and cold

storageWater, wastewater, and

solid waste management

infrastructureWater resources and irrigation

infrastructureBulk water carrier pipelines, irrigation networks and water storage

infrastructure (including its supporting structures, among others)

reservoir, dam, and weirWater supply infrastructure Raw water unit, production unit, distribution unit Wastewater infrastructure Centralized wastewater management systems including service

unit, collection unit, processing unit, final disposal unit, water

discharge pipeline, and sanitation

Local wastewater management system including local processing

unit, transport unit, sludge treatment unit, final disposal unit,

water discharge pipeline, and sanitationSolid waste management

infrastructureTransportation, processing, final waste processing ICT infrastructure Telecommunication

infrastructureTelecommunication network, passive infrastructure such as

transmission media cable ductsInformation technology and

informatics infrastructureE-government infrastructure Energy and

electricity

infrastructurePower generation Power generation facilities Power transmission and

sub-transmissionPower transmission and main substation facilities Power distribution Power distribution facilities Energy conservation infrastructure NA Social infrastructure Education infrastructure Education and skills development facilities Health infrastructure Hospital (i.e., hospital building, hospital infrastructure, and

medical equipment; basic health service facility, such as building,

infrastructure, and medical equipment for health center and/or

clinic; health laboratory, such as health laboratory building, health

laboratory, infrastructure, and laboratory equipment)Public housing Low-cost housing Government buildings NA Other infrastructure Zone infrastructure Industrial projects including industrial parks, special economic

zones, and related projectsOil and gas infrastructure,

including bioenergyProcessing, storage, transportation, distribution Tourism infrastructure Cultural centers, entertainment and recreational facilities, and

other tourism-related infrastructureSports, arts, and culture facility

infrastructureSports recreation facilities Penitentiary infrastructure NA Traditional market NA ICT = information and communication technology, NA = not applicable.

Source: Government of Pakistan, Public Private Partnership Authority. 2010. Pakistan Policy on Public Private Partnerships: Private Participation in Infrastructure for Better Public Services. Islamabad. http://www.lcwu.edu.pk/ocd/cfiles/City%20and%20Regional%20Planning/CRP-45/Lec5PPPPolicyFINAL14-May-2010.pdf.ICT = information communication technology.

National Framework for Enabling PPPs

PPP Institutional Framework

Does the country have a national PPP unit? What are the functions of the national PPP unit? Supporting the design and operationalization of the national PPP-enabling framework?

Helping develop a national PPP pipeline?

Supporting the arrangement of funding for project preparation (budgetary allocations, technical assistance funding from multilateral development agencies, operating a dedicated project preparation/project development fund)?

Guidance for project preparation to and coordination with the government agencies responsible for sponsoring the projects?

Making recommendations to the PPP Committee and/or other approving authorities to provide approvals associated with various stages of PPP process?

- Yes

LEARN MORENational Framework for Enabling PPPs

PPP Institutional Framework

Section 14 of the PPPA Amendment Act 2021 provides guidance on the approvals required for the qualified projects. Prior to the execution of the PPP agreement by the implementing agency, the act states that all qualified projects should obtain approval from

- the Public Private Partnership Working Party (P3WP) for the project qualification proposal;

- the Risk Management Unit for the project (in accordance with PPPA Amendment Act 2021, Section 12A);

- the Board of the Authority for the project proposal; and

- the Executive Committee of the National Economic Council for the project proposal (in the event the qualified project meets certain prescribed criteria, and any other approvals as may be prescribed from time to time).

The PPPA Amendment Act 2021 proposes to establish a risk management unit, which shall be managed, controlled, and administered by the Finance Division of the Federal Government for the PPPs. The risk management unit is currently envisaged to be part of the Debt Policy Coordination Office within the Ministry of Finance. As per the act, the risk management unit shall be responsible for fiscal oversight and evaluation of fiscal and contingent liability exposure for all qualified projects. Such evaluation may be required as prescribed by the Public Private Partnership Authority (PPPA) in consultation with the Finance Division. The act also provides that, in respect of any project that is not a qualified project, each implementing agency shall provide the risk management unit all the information about such project as may be prescribed by the PPPA in consultation with the Finance Division.

The Public Private Partnership Authority (also referred to as PPPA, the Authority, or P3A) was established by virtue of the PPPA Act 2017. It was notified in 2018 and rechristened P3A as per PPPA Amendment Act 20211 . The PPPA functions under the administrative control of the Ministry of Finance. Its mandate, among others, are to regulate PPP transactions; assist federal implementing agencies in developing, structuring, and procuring their infrastructure projects through private sector investment; and approve PPP transactions that provide value for funding solution to the public sector. The supervisory ministry has been changed from Ministry of Finance to Ministry of Planning, Development, Reforms, and Strategic Initiatives. The PPPA Amendment Act 2021 also elaborates on the powers of the PPPA, the extracts of which are provided below1 :

- ensure that “qualified projects” are consistent with national and sector strategies;

- ensure value for money by conducting an analysis to evaluate qualified projects in the manner as may be prescribed;

- conduct appraisal and project risk analysis for qualified projects;

- assess all funding requirements;

- advise, facilitate, and actively support the implementing agency to develop and structure, as needed, the qualified projects at all stages of the project cycle such as identification, planning, tendering, bidding, contract award, and implementation;

- standardize contractual provisions and develop sector-specific provisions and templates including a model PPP agreement for qualified projects;

- analyze and assess annuity, user-based, hybrid, and other financial models for qualified projects; and

- interact, collaborate, and liaise with international agencies.

The PPPA Amendment Act 2021 also proposes establishing the Public Private Partnership Working Party (P3WP), which, among other things, is responsible for

- granting approval of the project concept proposal submitted by the PPPA,

- granting approval of the project qualification proposal submitted by the PPPA, and

- performing other functions as may be prescribed from time to time.

One of the key responsibilities of implementing agencies as per PPPA Amendment Act 2021 is to “monitor and implement the project in accordance with the public–private partnership agreement.” It is thereby clear that the implementing agencies are responsible for monitoring the PPP projects after the award of the project.

For qualified projects, the power to monitor is assigned to the Board of P3A. One of the powers of the Board of P3A, as per the PPPA Amendment Act 2021, is “monitoring, in respect of qualified projects, the implementation of public–private partnership agreements, including in terms of the financial situation and the construction of physical assets and service delivery.”

- 1 a b Government of Pakistan, PPPA. Public Private Partnership Authority (Amendment) Act 2021. Islamabad. http://www.senate.gov.pk/uploads/documents/1612419098_271.pdf.

National Framework for Enabling PPPs

The PPP Process

Does the PPP legal and regulatory framework provide for a PPP implementation process covering the entire PPP life cycle? Does the Feasibility Assessment Stage cover Technical feasibility?

Socioeconomic feasibility?

Environmental sustainability?

Financial feasibility?

Fiscal affordability assessment?

Legal assessment?

Risk assessment and PPP project structuring?

Value for Money assessment?

Market sounding with stakeholders?

Is the PPP procurement plan required? Is there a need to set up a separate PPP procurement committee? Is competitive bidding the only method for selection of PPP private developer? Is the prequalification stage necessary? Or does the PPP legal and regulatory framework allow flexibility to skip the prequalification stage? Prequalification is not mandatory Does the PPP legal and regulatory process provide the option to the preferred bidder for contract negotiations? Does the PPP legal and regulatory framework allow unsuccessful bidders to challenge the award/submit complaints? What is the maximum time allowed for submitting a complaint/challenging the award by unsuccessful bidders from the announcement of the preferred bidder? 15 Days Does the PPP legal and regulatory framework provide for transparency? Which of the following are required to be published? Findings from the feasibility assessment?

Procurement notice?

Outcome of stakeholder consultations from market sounding?

Clarifications to prequalification queries?

Prequalification results?

Clarifications to pre-bid queries?

Results for the bid stage and selection of preferred bidder?

Final concession agreement to be entered between the government agency and the preferred bidder? And other PPP project agreements executed between government agency and preferred bidder?

Confidentiality

- Yes

- No

LEARN MORENational Framework for Enabling PPPs

The PPP Process

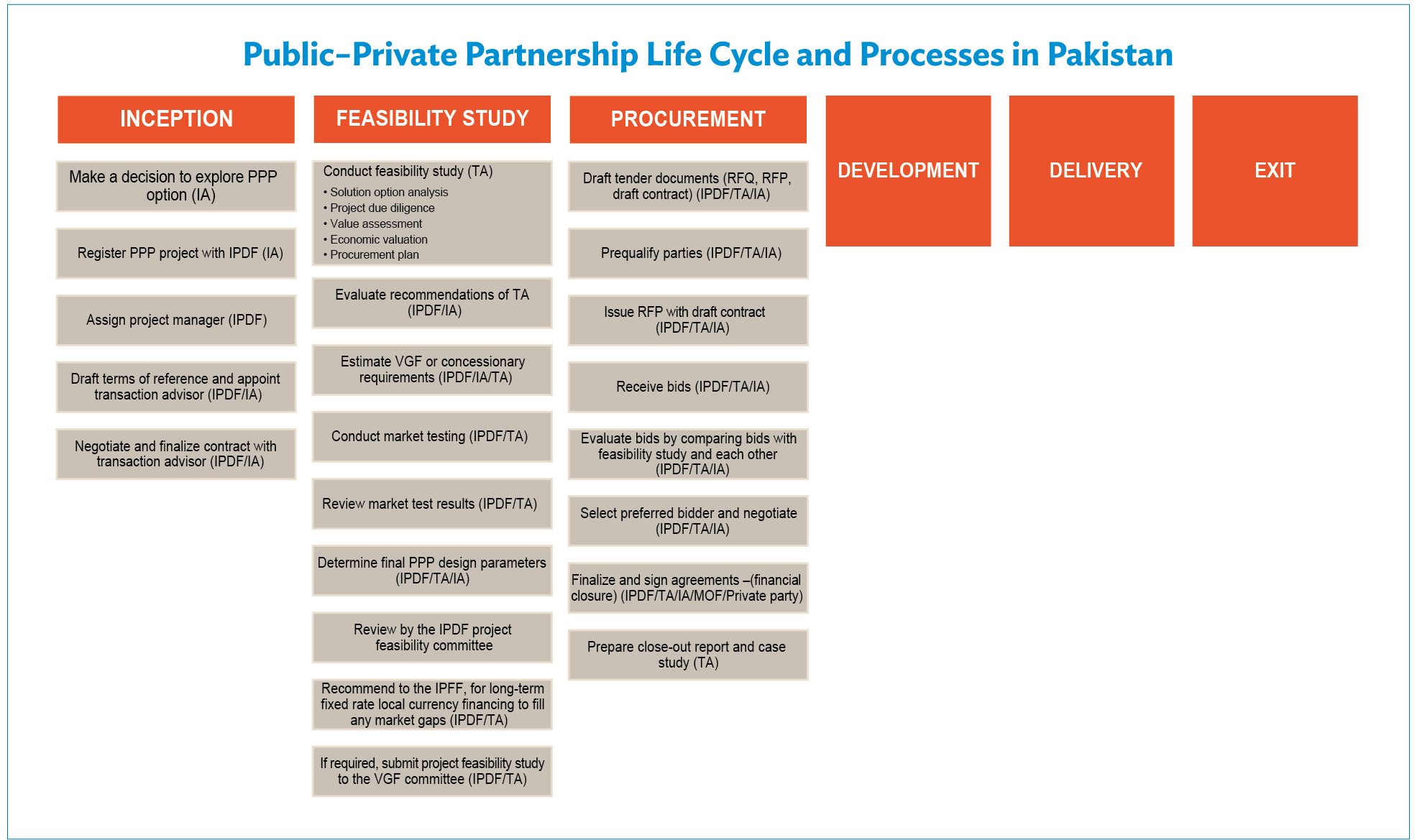

The PPP Policy of 2010 and the Project Preparation/Feasibility Guidelines for PPP Projects of 2007 could be considered as basis for the project preparatory activities for PPPs.

IA = implementing agency, IPDF = Infrastructure Project Development Facility (now Public Private Partnership Authority or P3A), IPFF = Infrastructure Project Finance Facility, MOF = Ministry of Finance, RFP = request for proposal, RFQ = request for qualification, TA = transaction advisor, VGF = viability gap funding.

Source: Government of Pakistan, Ministry of Finance, and IPDF. 2007. Project Preparation/Feasibility Guidelines for PPP Projects. Islamabad.

The Provincial Procurement Regulatory Authority (PPRA) Acts and Rules and the PPP Acts of the provinces control the PPP procurement functions in the provincial governments of Sindh and Punjab. Federal legislation is not fully aligned with the PPP procurement processes throughout the provinces of Pakistan. The federal PPRA Rules do not provide any framework for PPP procurements in the country. There is a need to align procurement laws and procedures at the federal and provincial levels to enable greater private sector participation and competition, and to create an aligned environment for PPPs across provincial boundaries.

PPP Procurement Process in Pakistan

Theme Description Responsible agency Line ministries, federal bodies, provincial and local authorities, and state-owned enterprises are the contracting parties on behalf of the federal government with private parties. They will therefore be responsible, mainly or in conjunction with other bodies, for the identification, selection, sponsorship, preparation, tendering, and monitoring of public–private partnership (PPP) projects in their sectors. The line ministries that want to promote PPPs will prepare model concession agreements for that particular sector. Strong support for the line ministries is available from institutions such as the Public Private Partnership Authority, the Ministry of Finance, and the Planning Commission. Project inception - A decision is made to explore the PPP for the development of a project.

- Potential PPP projects are identified from master plan or through preliminary needs analysis.

- The project is screened using multiple criteria.

- A decision is made on the option to pursue the project.

- The project is registered with the PPP Cell/Unit.

- The technical and financial proposals are evaluated.

Project preparation - Feasibility studies are carried out and their conclusions and recommendations are reviewed.

- A decision is made on whether to proceed with the project any further, or to reject or send back for reconsideration the project proposal.

Transaction execution - An information memorandum is prepared for project marketing.

- Market sounding of potential investors and lenders is conducted.

- Project structure and tender documents are finalized.

- Private partners for PPP projects are selected through transparent and competitive tendering, using a two-stage process of prequalification and bidding.

- A request for prequalification applications is issued. A notice is published inviting private companies and consortia of such companies to submit prequalification applications, based on appropriate predefined criteria such as legal requirements and technical and financial capability.

- Prequalification applications are evaluated to determine which among the companies and consortia meet these criteria.

- After prospective private partners have been prequalified, an invitation will be issued for these private parties to submit bids.

- A pre-bid conference will be conducted to clarify the terms and conditions of the draft PPP agreement.

- Received bids are evaluated. Bid evaluation will be carried out in two phases. First, the technical, operational, environmental, and commercial soundness of the bids received will be assessed through the requirements, criteria, and minimum standards specified in the tender documents. Noncompliant bids will be rejected. The responsive bids will be evaluated in the second phase from the financial viewpoint. The evaluation will be based on a parameter specified in the tender documents, which is also dependent on the type of the PPP project.

- Depending on the number of bids received, the procuring authority may need to restructure the project and re-bid if too few bids are received. Alternatively, if the required number of private bidders submit bids, a recommendation is made on the contract award to the approving authority.

- The awarding authority will decide on whether to approve or send back for reconsideration the contract award recommendation.

- Results of the bidding process are announced, and a notice of award is issued to the selected private partner.

- Negotiations are conducted with the preferred bidder. These negotiations focus on terms and conditions not directly specified in the tender documentation.

- The PPP agreement is signed.

- The conditions precedent to financial closure are fulfilled. The private partner will endeavor to achieve financial closure within the predetermined period specified in the tender documentation.

The period to achieve financial closure from signing of the PPP agreement should not be more than 12 months.

Construction, operation, and transfer - Project implementation is monitored to ensure conformity with plans and specifications.

- Project operation is monitored and evaluated to ensure conformity with performance standards and tariffs.

- Financial performance of the project is monitored and evaluated.

- Arrangements are made for the project transfer to the government at the end of the term of the PPP agreement.

Source: Asian Development Bank. 2019. Public–Private Partnership Monitor. Second Edition. Manila. https://www.adb.org/sites/default/files/publication/509426/ppp-monitor-second-edition.pdf.

Section 19 of the PPPA Amendment Act 2021 defines the aspect related to the agreement negotiation and indicates that:

-

The implementing agency shall, after all applicable approvals have been obtained in accordance with Section 17, invite the successful private party bidder for negotiation of the public–private partnership agreement on such terms and conditions as may be prescribed from time to time.

The PPPA Amendment Act 2021 also provides the implementing agencies a scope for entering into negotiated procurement in cases where the federal government approves such a case. Section 20 of the PPPA Amendment Act 2021 states that:

- Subject to the rules and regulations prescribed under this Act, an implementing agency may enter into a negotiated procurement of a project in case the Federal Government authorizes such an exception, for reasons to be recorded in writing, in the public interest.

The PPP Act is silent on the PPP life cycle and processes. The PPPA Amendment Act 2021, however, indicates that the provisions of the act shall supersede other extant acts, and authorizes the implementing agencies to seek private sector participation in appropriate projects. The PPP Act also indicates that appropriate rules and regulations will be formulated under the act to facilitate the entrance of implementing agencies into contracts with the private sector players. Subsequently, the process flow for approvals and for bidding and contract award shall be prescribed. The act also includes a new chapter on the legal and contractual framework for PPPs.

National Framework for Enabling PPPs

Standard Operating Procedures, Tool Kits, Templates, and Model Bid Documents for PPPs

Does the country have PPP Guidelines/PPP Guidance Manual? Does the PPP Guidelines/PPP Guidance Manual adequately cover the process, entities involved, roles and responsibilities of various entities, approvals required at various stages, and the timelines for the various stages of the PPP project life cycle? What are the templates and checklists available in the PPP Guidelines/PPP Guidance Manual? Project Needs Assessment and Options Analysis checklist?

Project Due Diligence checklist?

Technical Assessment checklist?

Environmental Assessment checklist?

PPP Procurement Plan template?

Does the country have standardizedmodel bidding documents for PPPs? Model Request for Qualification (RFQ) document?

Model Request for Proposal (RFP) document?

Model PPP/Concession Agreement?

State Support Agreement?

VGF Agreement?

Guarantee Agreement?

Power Purchase Agreement?

Capacity Take-or-Pay Contract?

Fuel Supply Agreement?

Transmission and Use of System Agreement?

Performance-Based Operations and Maintenance Contract?

Engineering, Procurement and Construction Contract?

Does the country have standardized PPP agreement terms? Does the country have standardized/ model tool kits to facilitate identification, preparation, procurement, and management of PPP projects? PPP Family Indicator?

PPP Mode Validity Indicator?

PPP Suitability Filter?

PPP Screening Tool?

Financial Viability Indicator Model?

Economic Viability Indicator Model?

VFM Indicator Tool?

Readiness Filter?

Is there a framework for monitoring fiscal risks from PPPs including the following? Process for assessing fiscal commitments?

a Process for approving fiscal commitments?

a Process for monitoring fiscal commitments?

a Process for reporting fiscal commitments?

a Process for budgeting fiscal commitments?

a Are there fiscal prudence norms/thresholds to limit fiscal exposure to PPPs? Is there a process for assessing and budgeting contingent liabilities from PPPs? - aArticle 12A of the Public Private Partnership Authority (PPPA) Amendment Act 2021 assigns the responsibility of reviewing and managing fiscal risks in PPP projects to the Risk Management Unit. The article states that the responsibility for fiscal oversight and for evaluation of fiscal and contingent liability exposure for all qualified projects shall lie with the Risk Management Unit. Such evaluation shall be determined by the Finance Division in consultation with the PPPA.

- Yes

- No

LEARN MORENational Framework for Enabling PPPs

Standard Operating Procedures, Tool Kits, Templates, and Model Bid Documents for PPPs

Implementation or concession agreement. The implementation agreement is the agreement signed between the federal government and the project company under which the federal government provides certain undertakings to the project (with respect to, for example, support to obtain consents and permits, taxation and import control undertakings, and undertakings with respect to foreign exchange and the availability of funds in Pakistan). The federal government also provides protection to sponsors and lenders in case of termination of the project agreements under specific circumstances. A sovereign guarantee is issued pursuant to the implementation agreement where the federal government guarantees the payment obligations of the power purchaser and the federal government.1

Energy/power purchase agreement. The energy/power purchase agreement (EPPA) or the power purchase agreement (PPA) is the agreement signed between the power purchaser and the project company under which the power purchaser buys the output from the project company and then sells the output in the market. The EPPA/PPA sets out the terms and conditions on which the power purchaser buys the output and/or capacity (as the case may be) from the project company. For the bankability of the project, the project company determines whether enough revenue will be generated from the project to service debt and make a profit to be distributed as dividends. The revenue generated from the EPPA/PPA is used to pay for, among other things, the operating expenses, debt servicing, and procuring fuel (in case of nonrenewable projects). The EPPA/PPA further provides protection to investors and lenders against specific political risks, and against changes in the tax and duty regime. Given a suitable indexation of tariff components, the EPPA/PPA covers the risk of losses due to exchange rate variations and inflation. Such protection, however, should be based on applicable tariffs (footnote 1).

Capacity take-or-pay contract. The capacity take-or-pay contracts require the power purchaser to make payments to the project company for making the output available, regardless of whether the output is off-taken or not. These contracts apply to nonrenewable projects. For renewable projects, the offtake requires to purchase all outputs of the companies(footnote 1).

Fuel supply agreements. The fuel supply agreement is the agreement signed between the project company and the fuel supplier for the sale and purchase of fuel that is necessary to operate the project. The fuel supply agreement sets out the terms and conditions of the sale and purchase of fuel. The fuel supply agreement is usually back-to-back with the PPA as the dispatch instructions are required for fuel ordering under this agreement. Performance obligations of the fuel supplier are no longer guaranteed by the federal government (footnote 1).

Performance-based operation and maintenance (O&M) contract. After completion of the construction of the works, a project company usually requires experts to operate and maintain the project during the concession period. An O&M contract therefore involves managing the operations of the project, providing maintenance of the complex, and running it as per the requirements of the system operator and based on the dispatch instructions of the power purchaser. Where the project does not operate on the thresholds required by the power purchaser, the power purchaser, in some instances, can withhold payments or collect damages (footnote 1).

Engineering, procurement, and construction contract. Even though the standard documentation for engineering, procurement, and construction (EPC) contracts are not International Federation of Consulting Engineers (FIDIC)-based, guidance is still derived from the FIDIC formats. Once financing has been arranged for the project by the project company, lenders usually require an EPC contract in place to commence construction works soon after the financial closure of the project. The project company enters into an EPC contract with a construction contractor who undertakes engineering, design, and construction of the project within certain timelines for the project to be functional by the time the power purchaser or federal government requires it to be functional. The project company requires the construction contract to provide warranties of the equipment installed, procure the necessary licenses and approvals for commissioning of the complex, complete the construction on time, and ensure functionality and performance of the completed works.

- 1Asian Development Bank. 2019. Public–Private Partnership Monitor. Second Edition. Manila.https://www.adb.org/sites/default/files/publication/509426/ppp-monitorsecond-edition.pdf.

VFM = value for money, VGF = viability gap funding.

At the federal level, the Government of Pakistan issued the Project Preparation/Feasibility Guidelines for PPP Projects in August 2007 and the Policy on Public–Private Partnerships in January 2010.

Key Clauses Related to PPP Agreement

The PPPA Amendment Act 2021 prescribes that every agreement shall be governed, construed, and interpreted in accordance with the laws of Pakistan and shall include the following key clauses: 1

- scope of activities of the parties to the agreement;

- duration of the agreement;

- payment arrangements for the private party, including, where applicable, the factors based on which and the manner in which user charges or tariffs may be revised;

- rights and obligations of the parties and the respective risks to be borne by each party;

- penalties for noncompliance with the provisions of the PPP agreement;

- dispute resolution mechanisms;

- exit clauses specifying the procedure of early termination of the PPP agreement;

- termination payments and compensations, if agreed and provided in the PPP agreement;

- debt–equity ratio;

- monitoring;

- project insurances and treatment of insurance proceeds;

- O&M requirements; and

- reversion, transfer, or handing back of the project, wherever applicable, and all the associated assets to the implementing agency upon expiry or termination of the PPP agreement.

- 1Government of Pakistan, PPPA. Public Private Partnership Authority (Amendment) Act 2021. Islamabad. http://www.senate.gov.pk/uploads/documents/1612419098_271.pdf.

Does the law specifically enable lenders the following rights: Security over the project assets?

Security over the land on which they are built (land use right)?

Security over the shares of a PPP project company?

Can there be a direct agreement between the government and lenders?

Do lenders get priority in the case of insolvency?

Can lenders be given step-in rights?

Does the law specifically enable compensation payment to the private partner in case of early termination due to: Public sector default or termination for reasons of public interest?

Private sector default?

Force majeure?

Does the law enable the concept of economic/financial equilibrium? Does the law enable compensation payment to the private partner due to: Material adverse government action?

a Force majeure?

Change in law?

- aThere is no specific provision on material adverse government action in the Act; however, there is no prohibition on the same either. It may be inferred that the PPP Authority could include it based on the context.

- Yes

- No

LEARN MORENational Framework for Enabling PPPs

Standard Operating Procedures, Tool Kits, Templates, and Model Bid Documents for PPPs

In securing loans for projects, the laws of Pakistan allow project companies to procure loans from both local and foreign banks and financial institutions. The primary legislations dealing with investment matters are the Investment Policy, the Reforms Act, the Foreign Exchange Regulation Act 1947, the Foreign Exchange Manual, and various notifications and circulars issued by the State Bank of Pakistan (SBP) from time to time pertaining to foreign exchange.1

Section 13 (1) (b) of the Foreign Exchange Regulation Act prohibits transfer of any security, or creation or transfer of any interest in a security to or in favor of a nonresident, except with the general or special permission of the SBP. General permissions are those that are already contained in the Foreign Exchange Manual. Where the Foreign Exchange Manual does not provide general permission, special permission of the SBP has to be sought.

Security over the project assets

In Pakistan, security may be created over the company’s project assets through hypothecation in favor of lenders. The project company may also enter into a Letter of Lien and Set-Off, which usually applies to the project accounts of the company.

Security over the land on which they are built (Land Use Right)

Security over the company’s immovable assets (land) is generally created in the form of an equitable mortgage by deposit of land title deeds to avoid levying of a significant amount of duty. The security instrument is a Memorandum of Deposit of Title Deeds, which confirms the creation of the security over the shares of a PPP project company.

Can there be a direct agreement between the government and the lenders?

Generally, direct agreements are acceptable forms of security. They are often included in project finance transactions executed in Pakistan. They also apply to PPP projects (footnote 1).

Do lenders get a priority in case of insolvency?

Lenders do get a priority in case of insolvency to the extent of the registration of their charges against the borrower’s assets. Such charge registration is perfected through filling out Form 10. The Securities and Exchange Commission of Pakistan then issues a charge certificate acknowledging the security perfection. Therefore, if the lenders have perfected a first ranking charge, they will get a priority in case of insolvency. However, before such priority can be exercised by the lenders, in case of insolvency, any outstanding amounts to the government in the form of taxes, utility bills, or land dues are deducted first (footnote 1).

Can lenders be given step-in rights?

Step-in rights are given to lenders through direct agreements. This is a well-established practice. Under the standard concession agreements for the power sector, the counterparty is restricted from terminating such concession agreements without first giving a copy of any notice required to be given to the project company and to the lenders. The lenders are entitled to cure or procure the cure of any defaults of the project company within the cure period allowed. Lenders are also allowed to assume operations of the facilities and granted extended cure periods to remedy the project company’s defaults.

- 1Asian Development Bank. 2019. Public–Private Partnership Monitor. Second Edition. Manila. https://www.adb.org/sites/default/files/publication/509426/ppp-monitorsecond-edition.pdf.

Source: Asian Development Bank. 2019. Public–Private Partnership Monitor. Second Edition. Manila. https://www.adb.org/sites/default/files/publication/509426/ppp-monitor-second-edition.pdf.

National Framework for Enabling PPPs

Unsolicited PPP Proposals

Does the PPP legal and regulatory framework allow submission and acceptance of unsolicited proposals? What are the advantages provided to the project proponent for an unsolicited bid? Competitive advantage at bid evaluation?

Swiss Challenge?

Compensation of the project development costs?

Government support for land acquisition and resettlement cost?

Government support in the form of viabiity gap funding and guarantees?

- Yes

- No

LEARN MORENational Framework for Enabling PPPs

Unsolicited PPP Proposals

Although unsolicited proposals are not expressly prohibited in Pakistan under the Federal PPP Law, they are not preferred by the federal government due to potential issues relating to lack of transparency and unequal treatment of bidders. Some provinces (e.g., Sindh and Punjab) have adopted their own practices when dealing with an unsolicited proposal. With regard to project development cost, in the province of Punjab, for example, the project proponent shall be reimbursed costs for preparing and submitting an unsolicited proposal. In the event the proponent fails to be adjudged as the best evaluated bidder, the cost of preparation of the unsolicited proposal shall be determined by the government authority. There is no such reference found with regard to the treatment of project development cost under federal PPP laws.1 Also, under the Sindh PPP framework, after the provincial government of Sindh approved the unsolicited proposal, a Swiss Challenge process will be followed through a two-step procedure (prequalification and tender). The unsolicited proposal proponent will be exempt from the prequalification requirement and will gain a 5% additional weightage in the combined score of the technical and financial evaluation, as well as a right of first refusal (or a right to match).2

Various considerations are applicable with respect to unsolicited proposals, including being able to demonstrate innovation, reasoned analysis, a match to the requirements of the country, and the project’s likely inability to be procured through an alternative method. The federal government may decide whether unsolicited proposals would require competitive bidding during the project procurement. The provincial framework allows for certain benefits to be awarded to the proponent of the unsolicited proposal during the competitive bidding process. These include exemption from prequalification, additional weightage of points during the evaluation process, and a right of first refusal.

- 1Asian Development Bank. 2019. Public–Private Partnership Monitor. Second Edition. Manila. https://www.adb.org/sites/default/files/publication/509426/ppp-monitor-second-edition.pdf.

- 2ADB Pakistan Resident Mission; ADB Office of Public–Private Partnership.

Source: Asian Development Bank. 2019. Public–Private Partnership Monitor. Second Edition. Manila. https://www.adb.org/sites/default/files/publication/509426/ppp-monitor-second-edition.pdf.

The Public Private Partnership Authority (PPPA) Amendment Act 2021 reiterates that unsolicited proposals could be considered for further evaluation. Further details, including those related to procedures to evaluate and reward a private sector player, may be provided in the subsequent issuance of rules and regulations. The newly introduced Section 14A of the PPP Act states that:

-

A private party may submit proposal for a project on an unsolicited basis to the authority or an implementing agency in the manner in meeting such requirements as prescribed, which shall be subject to procurement procedures prescribed from time to time.

National Framework for Enabling PPPs

Foreign Investor Participation Restrictions

Is there any restriction for foreign investors on: Land use/ownership rights as opposed to similar rights of local investors?

Currency conversion?

PPP projects with foreign sponsor participation (number) 54 - No

LEARN MORENational Framework for Enabling PPPs

Foreign Investor Participation Restrictions

Foreign investors are restricted from holding Pakistani securities without the prior general or special permission of the State Bank of Pakistan (SBP). Under the Foreign Exchange Manual 2017, the SBP has granted general permission or exemption to foreign nationals and firms (including partnerships), trusts, and mutual funds registered outside Pakistan, subject to certain conditions. There are no restrictions on the purchase price paid to a nonresident shareholder already holding Pakistani securities in accordance with the general or special permission of the SBP. However, such general permission is not available for entities owned or controlled by a foreign government, which require the prior written permission of the SBP.1

Foreigners holding Pakistani securities in accordance with the general or special permission of the SBP are entitled to repatriation of dividends and disinvestment proceeds net of Pakistan tax liability. Remittance of disinvestment proceeds exceeding the break-up value of the shares, as certified by a practicing, chartered accountant in Pakistan, requires the prior written permission of the SBP.1

Pursuant to the Foreigner Act, the federal government has ordered that no foreigner shall, directly or indirectly, acquire land or any interest in land or landed property in Pakistan, except with the previous permission of the federal government or of the provincial government. Permission from the federal government or respective provincial government may be granted on a routine basis as part of the approval process for the relevant PPP project. By way of established practice, the above restriction has not been applied to ownership of land by companies incorporated in Pakistan, even where such companies are owned or controlled by foreign investors.

- 1 a b Asian Development Bank. 2019. Public–Private Partnership Monitor. Second Edition. Manila. https://www.adb.org/sites/default/files/publication/509426/ppp-monitorsecond-edition.pdf.

As per the Pakistan Investment Policy 2013 (Investment Policy), all sectors and activities are open for foreign investment unless specifically prohibited or restricted for reasons of national security and public safety. Specified restricted industries include arms and ammunitions; high explosives; radioactive substances; securities, currency, and mint; and consumable alcohol. There is no upper limit on the share of foreign equity allowed, except in specific sectors including airline, banking, agriculture, and media. For corporate agriculture farming, foreign investors are allowed to hold 100% equity.

National Framework for Enabling PPPs

Dispute Resolution

Does the country have a Dispute Resolution Tribunal? Does the country have an Institutional Arbitration Mechanism? Can a foreign law be chosen to govern PPP contracts? What dispute resolution mechanisms are available for PPP agreements? Court litigation

Local arbitration

International arbitration

Has the country signed the New York Convention on the Recognition and Enforcement of Foreign Arbitral Awards? - Yes

- No

Source: Asian Development Bank. 2019. Public–Private Partnership Monitor. Second Edition. Manila. https://www.adb.org/sites/default/files/publication/509426/ppp-monitor-second-edition.pdf.

Pakistan has no dispute resolution tribunal nor an institutional arbitration mechanism. It all depends on the arbitration clauses in the agreement. Article 18 of the PPPA Amendment Act 2021 relates to the settlement of disputes. The PPPA Amendment Act 2021 stipulates the provision of the PPP agreement for resolution of disputes between the parties. It also prescribes that the federal government require the private party to exhaust all domestic dispute resolution remedies including recourse to domestic courts before seeking international arbitration. The act provides the parties an option to refer the dispute to the PPPA for settlement through mediation.

As to foreign jurisdiction clauses, the courts in Pakistan have held that these clauses are valid under Pakistan law. However, the jurisdiction provision will not be construed as ousting the jurisdiction of Pakistan’s courts but will be dealt with in the same manner as an arbitration clause in the event of legal proceedings being instituted in a court in Pakistan. Accordingly, in the event that any legal proceedings are instituted by a party in Pakistan, even when the contract is governed by the laws of a foreign country, the other party against whom the legal proceedings have been instituted can apply for stay of the proceedings in terms of section 34 of the Pakistan Arbitration Act 1940.

Arbitration

There are two major statutory instruments that govern arbitration in Pakistan: the Arbitration Act 1940, which applies to local arbitrations, and the Recognition and Enforcement (Arbitration Agreements and Foreign Arbitral Awards) Act 2011, which applies to foreign arbitrations. Neither of these are based on the United Nations Commission on International Trade Law Model Law.1

Pakistan is a contracting state to the New York Convention on the Recognition and Enforcement of Foreign Arbitral Awards (the New York Convention). Pakistan became a signatory to the convention on 30 December 1958 and it was ratified on 14 July 2005.2

The New York Convention was first implemented under the Recognition and Enforcement (Arbitration Agreements and Foreign Arbitral Awards) Ordinance 2005, which was subsequently re-promulgated from time to time (Foreign Arbitration Ordinances), before it was enacted as the Recognition and Enforcement (Arbitration Agreements and Foreign Arbitral Awards) Act 2011 on 19 July 2011 (Foreign Arbitration Act). The Foreign Arbitration Ordinances, which are promulgated from time to time, and the Foreign Arbitration Act are substantially identical. In terms of Article V of the New York Convention, a foreign arbitral award will not be enforced where recognition and enforcement of the same would be contrary to the public policy of Pakistan.

- 1RIAA Barker Gillette. 2020. In Brief: Arbitration Formalities in Pakistan. Lexology. 16 June. https://www.lexology.com/library/detail.aspx?g=04064317-ff25-4a12-945c-5be1bd761f25

- 2Bhandari Naqvi Riaz. 2020. First-Step Analysis: Arbitration in Pakistan. Lexology. 24 February. https://www.lexology.com/library/detail.aspx?g=fb17baa0-25f4-4416-ae1e-32fadc655bda

National Framework for Enabling PPPs

Environmental and Social Issues

Is there a local regulation establishing a process for environmental impact assessment? Is there a legal mechanism for the private partner to limit environmental liability for what is outside of its control or caused by third parties? Is there a local regulation establishing a process for social impact assessment? Is there involuntary land clearance for PPP projects? - Yes

- No

- Unavailable

LEARN MORENational Framework for Enabling PPPs

Environmental and Social Issues

- Initial Environmental Examination

Under the Pakistan Environmental Protection Act 1997 (PEPA) and concurring provincial laws, no proponent of a project can commence construction or operation unless

- – the proponent has filed an initial environmental examination (IEE) with the relevant environmental protection agency; or

- – where the project is likely to cause an adverse environmental effect, an environmental impact assessment (EIA) has been conducted and the project has been approved.

An IEE essentially involves a preliminary environmental review of the reasonably foreseeable qualitative and quantitative impacts on the environment of a proposed project. It aims to determine whether the project is likely to cause an “adverse environmental effect” for requiring preparation of an EIA.

- Environmental Impact Assessment Approvals

An EIA requires an environmental study comprising collection of data; prediction of qualitative and quantitative impacts; comparison of alternatives; evaluation of preventive, mitigatory, and compensatory measures; formulation of environmental management and training plans and monitoring arrangements; framing of recommendations; and other components as may be prescribed by rules.

Upon receipt of the EIA approval from the relevant environmental protection agency and before commencing construction of the project, the proponent is required to provide an undertaking acknowledging acceptance of the terms of the EIA approval. Thereafter and prior to operation of the project, the proponent has to submit an environmental management plan and request for a confirmation from the relevant environmental protection agency of compliance to the conditions of the EIA approval. Upon receipt of such confirmation the project company can commence operations.

In the Province of Sindh, the IEE and EIA approvals are regulated under the Sindh Environmental Protection Agency (Review of Initial Environmental Examination and Environmental Impact Assessment) Regulations 2014 (Sindh IEE and EIA Regulations). However, the requirements in the Sindh IEE and EIA Regulations mirror the requirements of the IEE and EIA Regulations, as summarized above.

Source: Asian Development Bank. 2019. Public–Private Partnership Monitor. Second Edition. Manila. https://www.adb.org/sites/default/files/publication/509426/ppp-monitor-second-edition.pdf.

Local Regulation for Initial Environmental Examination and Environmental Impact Assessment

The Pakistan Environmental Protection Act 1997 (PEPA) is the principal environmental legislation in the country. In all four provinces and at the federal level, environmental protection agencies were established under the provision of the PEPA.

The environmental protection agencies carry out initial environmental examination (IEE) and environmental impact assessment (EIA) in their respective jurisdictions.

At the federal level and for the provinces of Punjab, Khyber Pakhtunkhwa, and Balochistan, the process of applying for and obtaining the IEE and the EIA is regulated under the Pakistan Environmental Protection Agency (Review of IEE and EIA) Regulations 2000 (IEE and EIA Regulations).

Local Regulation for Social Impact Assessments

There is no local regulation for social impact assessments (SIAs) in Pakistan. In the province of Punjab, however, to assess the social consequences of PPP projects, guidelines have been issued by the Public Private Partnership Cell, Planning and Development Department, the provincial government of Punjab (collectively referred to as Punjab SIA Guidelines).

Under the Punjab SIA Guidelines, SIAs can be undertaken as part of an environmental assessment process, or independently, if required, to better assess the social consequences, both positive and negative, of implementing a PPP project. However, no process has been defined for PPPs to conduct SIA and neither has a regulator been identified for carrying out the SIA .

Other than Punjab, in all other provinces and at the federal level, no such guidelines have been developed. However, it has been observed that both Sindh and Punjab apply the Environmental and Social Management System when implementing PPP projects.

National Framework for Enabling PPPs

Land Rights

Which of the following is permitted to the private partner: Transfer land lease/use/ownership rights to third party

Use leased/owned land as collateral

Mortgage leased/owned land

Is there a legal mechanism for granting wayleave rights, for example, laying water pipes or fiber cables over land occupied by persons other than the government or the private partner? Is there a land registry/cadastre with public information on land plots? Which of the following information on land plots is available to the private partner? Appraisal of land value

Landowners

Land boundaries

Utility connections

Immovable property on land

Plots classification

- Yes

LEARN MORENational Framework for Enabling PPPs

Land Rights

The land acquisition options include the following:

- Acquisition of the land by the provincial government (whether voluntary or compulsory)—the land being sold or leased thereafter to the private developer

-

Where the provincial government acquires land, pursuant to the Land Acquisition Act, in any locality that is likely to be needed for public purpose or for a company, it shall require the company to enter into an agreement with the provincial government. The land can only be utilized for the purposes specified in the agreement with the provincial government for the purchase of land. Section 43-A of the Land Acquisition Act provides that no company for which any land is acquired shall be entitled to transfer the said land or any part thereof by sale, mortgage, gift, lease, or otherwise except with the previous sanction of the provincial government.

-

Furthermore, in case a private partner, being a tenant under the Colonization of Government Lands Act (CGLA), holding land in an area owned by the provincial government of Punjab, shall not, pursuant to Section 19 of the CGLA, transfer or charge by sale exchange, gift, will, mortgage, or other private contract of any form, other than a sublease, any rights or interests vesting in the tenant under the CGLA, without the consent in writing of the commissioner appointed by the Board of Revenue of the Revenue Department of Government of Punjab.

-

For the purposes of using leased and/or owned land as collateral, the right to use land to create a security varies in terms of the PPP laws in the respective provinces.

-

Lenders, over the immovable properties as collateral, except with the prior approval of the board of the federal PPP authority. The financing of a PPP project in other provinces is dependent upon the terms and conditions determined by the parties to the PPP agreement, or may be subject to any restriction that may be contained in the concession contract to create security interests over any of its assets, rights, or interests, including those relating to the infrastructure project to secure any financing for the project.1

-

- Voluntary acquisition of the land by the private developer or partner

-

A private developer can freely acquire land through sale and/or purchase and the immovable property can be transferred to a purchaser via a registered instrument.

-

In case the land is privately acquired for the project, then, subject to the municipal and other regulatory restrictions or consents pertaining to a PPP project, the owner of the land is free to utilize and transfer the land as it wishes. Where the land is leased, then, such land would be subject to the terms specified in the lease agreement. The land can be used for a specific term which would be specified in the lease agreement. The term of the lease should ideally match the life of the project.

-

The Transfer of Property Act (TPA) allows for the creation of a charge over immovable property—where either by the act of the parties to the PPP arrangement or by operation of law whereby the immovable property is made as a security for the payment of money to another, and the transaction does not amount to a mortgage.

-

Moreover, a company may mortgage its acquired land through a mortgage deed. Mortgages, under the TPA, can be made of a specific immovable property for the purpose of securing the payment of money in advance or to be advanced by way of loan, an existing or future debt, or the performance of an engagement which may give rise to a pecuniary liability.

-

- 1Asian Development Bank. 2019. Public–Private Partnership Monitor. Second Edition. Manila. https://www.adb.org/sites/default/files/publication/509426/ppp-monitorsecond-edition.pdf.

Sources: Asian Development Bank (ADB) 2019. Public–Private Partnership Monitor. Second Edition. Manila. https://www.adb.org/sites/default/files/publication/509426/ppp-monitor-second-edition.pdf; ADB Pakistan Resident Mission Pakistan; and ADB Office of Public–Private Partnership.

The numerous land laws in Pakistan are central to the PPP transaction and are relevant for local and foreign users or owners of land.

The key regulations governing land in Pakistan are as follows:

- The Transfer of Property Act 1882.

- The Land Acquisition Act 1894.

- The Registration Act 1908.

- The Stamp Act 1899.

- The Easements Act 1882.

- Punjab Land Records Authority Act 2017.

- The Colonization of Government Lands (Punjab) Act 1912.

- The Colonization of Government Lands Act 1912 (in its application to the Province of Sindh).

- The Land Revenue Act 1967.

Various portions of land in Pakistan belong to the state. State-owned land in Pakistan may be leased, granted, or assigned to individuals or corporations for various purposes. In most cases where state land is used by non-state entities, the land remains in the possession of the state with rent payable from the tenants to the state, such as in a leasing arrangement where such land is leased out to private developers on the terms stipulated in the lease. The regulatory environment in Pakistan provides the procuring authority the ability to make available the necessary land or right-of-way to PPP project companies for the development of PPP projects.

The rights, terms, and conditions pertaining to land are determined on a case-to-case basis.

Acquisition of Land by a Foreigner

In relation to the ownership of land, the federal government in exercise of its powers, under the Foreigner Act 1946, has ordered that no foreigner shall, directly or indirectly, acquire land or any interest in land or landed property in Pakistan except with the previous permission of the federal government or of the provincial government.